Customer Experience in Insurance: Strategies to Boost Customer Satisfaction

With growing competition and customer expectations in insurance, providing positive experiences is more important than ever before. Insurance providers should invest in personalization, digital solutions, and agent-customer interactions to satisfy and retain customers.

Did you know that one negative experience is enough for 50% of customers to switch to a competitor? This is especially true in insurance, where customers have diverse preferences and a growing demand for personalized services. There are several best practices, trends, and challenges you need to consider to deliver an exceptional customer experience in insurance.

What is Customer Experience in Insurance?

Customer experience (CX) in insurance refers to the overall journey customers go through when purchasing a policy from an insurance provider. Customers are increasingly demanding faster, more accurate, and personalized experiences. These expectations stem from a need for both efficient digital solutions and the human touch of in-person interactions.

As a result, CX is now a major differentiator in the hyper-competitive insurance industry. Corporations like Amazon and Google are also entering the space, making it more difficult for incumbents to stand out. Insurance companies that can successfully provide seamless experiences will likely come out on top with a base of satisfied and loyal customers.

There are various types of customer experiences in the insurance sector. Here’s a quick breakdown of customer expectations by category:

- Health insurance customer experience:

Customers expect easy access to healthcare networks. They expect fast claims processing and personalized health management. Clear communication and self-service tools are crucial to their satisfaction. - Life insurance customer experience:

Life insurance customers need clear, simple communication about policy terms. They expect personalized financial advice and a smooth application process to build trust. - Property and Casualty (P&C) insurance experience:

P&C customers want fast claims resolution and easy-to-understand policies. They also appreciate risk management tools like home protection services and real-time alerts. - Auto insurance customer experience:

Auto insurance customers value personalized offers based on driving habits. They want fast claims handling and easy-to-use mobile apps to manage policies. - Commercial insurance customer experience:

Commercial clients need customized solutions for their specific industry risks. They expect expert advice, dedicated support, and flexible policies. - Home insurance customer experience:

Home insurance customers want clear coverage options and quick claims processing. They appreciate proactive communication on potential risks like weather hazards.

Importance of Customer Experience in Insurance

A 2023 McKinsey survey of over 8,500 North American insurance customers suggests that CX initiatives are crucial to revenue growth and employee satisfaction.

Here are a few key reasons why it’s important for companies to embrace a customer-centric approach:

- It enhances customer retention and loyalty. A positive customer experience fosters trust and satisfaction. It makes policyholders more likely to stay with an insurer long-term. Customers who feel valued are more inclined to renew policies and become loyal brand advocates.

- It improves customer satisfaction across all touchpoints. Quick, transparent, and efficient services reduce frustration and improve the customer journey. By leveraging digital solutions and user-friendly interfaces, insurers can enhance customer satisfaction at every touchpoint.

- It gives insurance brands a leg-up on the competition. In an industry where products are often similar across providers, customer experience can be a key differentiator. Insurers who offer exceptional experiences can stand out in the marketplace and continue attracting new clients to maintain their competitive edge.

- It boosts the insurer’s brand reputation. A strong focus on customer experience goes a long way toward improving a company’s public image. Satisfied customers are more likely to share positive reviews and recommend the company to peers. As a result, good customer experiences enhance an insurer’s brand reputation management efforts.

- It enhances operational efficiency. Investing in CX initiatives spells internal benefits for the insurance providers themselves. For instance, by utilizing chatbots to quickly respond to customer complaints, companies can save hours’ worth of time that can be invested into building rich customer relationships.

Insurance Customer Experience Statistics

The following statistics highlight modern customer expectations and opportunities that insurers can leverage to meet their business objectives:

- CX leaders in the insurance industry outperformed their competitors in total shareholder return (TSR) by 20% for life insurers and 65% for property & casualty (P&C) insurers between 2017 and 2022. (McKinsey & Company)

- Approximately one in six customers report that insurers don’t follow up with them after an initial discussion. (McKinsey & Company)

- Virtual assistants are in use by only 16% of insurers, but 38% of consumers find value in AI-based communication. (Mendix)

- Human agents and advisers remain the highest-rated channel for customer satisfaction, with 20% of customers willing to switch insurers if their adviser left. (McKinsey & Company)

- 49% of customers believe a human advisor is more trustworthy in filing a claim than an automated service or a chatbot. (Mendix)

- 50% of five-star ratings from insurance customers highlighted that a “positive or empathetic adjuster attitude and handling approach” is important to their satisfaction. (Hi Marley)

- A successful customer-centric approach results in a 20% boost in employee satisfaction for insurance companies. (McKinsey & Company)

How to Improve Customer Experience in Insurance?

Personalization, multi-channel journeys, and customer convenience are key to improving CX in insurance. Here are some strategies for enhancing customer retention and loyalty:

1. Ensure an Omnichannel Customer Journey

Customers are no longer comfortable restricting themselves to a single interaction channel. They expect a consistent experience from their insurance provider wherever they are.

For example, let’s say a customer interacts with an agent via email for the first time. Later, they pick up the phone to have a direct conversation to discuss the issue further. They expect the company to have a record of their communication so far to ensure minimal delay.

This expectation stems from a need for convenience. Customers want to interact in various ways and expect smooth transitions between channels. The takeaway for insurers is to invest in multiple communication channels. Each channel should be reliable, safe, and easy to use.

Another good practice is to synchronize customer data across these channels. Building an omnichannel customer experience makes the process smooth for customers as they don’t have to repeat information or stick to one channel.

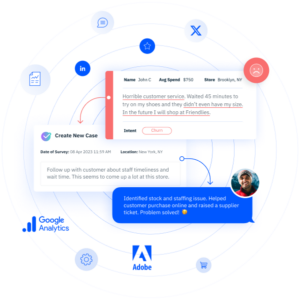

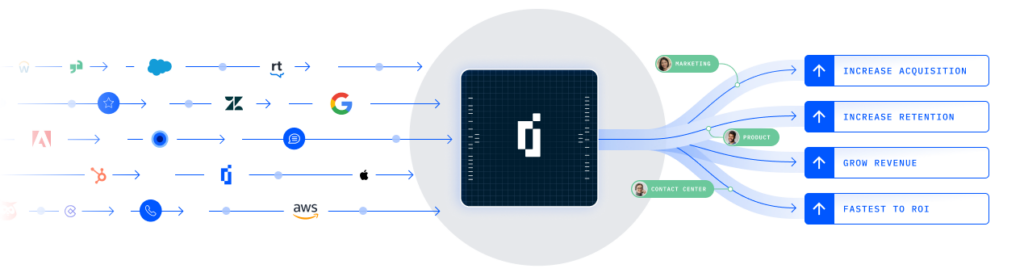

Pearl-Plaza is the premier solution for insurance providers looking to build an omnichannel customer experience. The Pearl-Plaza platform is built to help you monitor and analyze data from multiple sources such as reviews, calls, and survey responses.

2. Deliver Personalized Experiences

Personalization is a cornerstone of exceptional customer experience in the modern age. In fact, it’s one of the most impactful applications for collecting customer feedback. The insights into individual behavior and expectations help businesses tailor their services accordingly. For example, insurers can provide specific risk assessments based on customer profiles.

Pearl-Plaza’s XI Platform can help by collecting data from every channel and organizing it into one central location to gain a complete understanding of the customer, which allows you to deliver a more personalized experience.

This approach makes customers feel valued and heard. Therefore, personalization makes them more likely to stay loyal to you.

3. Invest in Digital Channels

Customers are increasingly keen on digital interactions. Apps and websites simplify a range of tasks, from purchasing policies to submitting claims. Unfortunately, insurers still struggle to provide quality digital experiences. Over 30% of customers express dissatisfaction with the digital channels available.

One of the best ways for insurance companies to stand out is to invest in reliable, secure, and efficient digital channels. Features such as instant quotes, real-time support, and eForms help provide a smooth customer experience.

4. Train Employees

While digital channels are important, in-person experiences still matter, especially for complex inquiries. 53% of customers want an in-person interaction before purchasing an insurance product.

Leveraging the human touch is important for insurance companies to strengthen customer relationships. Training your staff to be empathetic, knowledgeable, and efficient can go a long way. It can greatly enhance customer satisfaction during critical touchpoints across the customer journey.

Also, it’s important to ensure consistent service from frontline staff across all your physical locations. Inconsistent customer experiences result in mixed reviews, which makes it difficult to attract prospects.

5. Simplify Products

Purchasing insurance products can be an intimidating process. By simplifying your offerings, you make it easier for customers to make informed decisions. Simplified products and clear communication also increase transparency. This enhances customer trust in your brand and makes it more likely that you get positive reviews.

6. Educate Customers on Risk Prevention

Educational content on risk prevention and management can help customers make informed decisions. It encourages good daily habits, like safe driving and staying healthy, to minimize relevant insurance costs. By educating customers, you also establish yourself as a reliable authority and strengthen your relationship with them.

7. Make Documents Mobile-Friendly

Customers expect smooth access to important information on their smartphones. This helps them make decisions or seek support on the go. Mobile-friendly documents enable this convenience by offering accessible and readable content on customers’ devices.

8. Leverage AI & Chatbots

Chatbots enable customers to find quick answers to their questions without having to wait for a human agent.

For example, a chatbot can guide customers through the claims filing process after a car accident. It would start by requesting relevant details, such as the accident date and type of damage. After processing the information, the chatbot can leverage its knowledge base to suggest next steps and personalized advice.

The self-service enabled by chatbots can help your business by reducing support costs. It helps improve customer satisfaction by cutting down on wait times and increasing efficiency.

9. Offer Flexible Policy Options

Flexible policy options allow customers to customize their coverage and only pay for the insurance they need. Many customers appreciate the ability to tailor aspects of their policy, like coverage limits and deductible amounts. Therefore, by introducing flexibility, you can make your offerings accessible and improve customer convenience.

A wider range of options also helps you attract more customers from different financial backgrounds. Existing customers are also more likely to be loyal to a business that adapts to their needs.

10. Prioritize Data Security

The sensitive nature of the information in insurance transactions makes data security crucial. Customers need an assurance that you will protect their data from misuse or information breaches.

Investing in measures like encryption and secure data storage will help you better protect customer privacy. Your commitment to security will also improve your brand credibility by making it easier for customers to trust you.

Insurance Customer Experience Best Practices

The following practices can help you deliver consistent and rich experiences to customers with a focus on transparency and efficiency:

- Collect regular customer feedback and act on it. Gathering and analyzing customer feedback enables a deeper understanding of the individuals you’re serving. For instance, with the help of a customer feedback questionnaire, you can ask targeted questions that give you relevant information. The data can help you make immediate adjustments to customer service operations.

- Be transparent with your customers. Prioritizing clear communication and transparency across all touchpoints of the customer journey will help you reduce frustration and enhance long-term trust in your brand.

- Streamline workflows. Simplifying the application and underwriting processes will help you attract prospects away from competitors. This is because customers are always going to choose the most convenient and easy to use option. Investing in automated pipelines for tasks like claims processing and policy issuance will reduce wait times for customers. It will also save you time that can be utilized in other aspects of your service.

- Personalize the customer experience. Tailoring your products and services to cater to individual preferences enables you to enhance customer satisfaction and retention.

- Continuously improve and adapt to changing customer needs. Customer expectations will keep changing, especially during these uncertain economic times. It’s a good practice for insurers to stay flexible and track customer sentiment over time. This ensures your services stay relevant and impactful despite the economic climate.

Popular Customer Experience Trends in Insurance

Looking at some of the CX trends in insurance can help you identify what you’re doing right and what you can improve. The following trends are emerging as key drivers of growth for insurers:

- There is a growing demand for personalization. Customers expect personalized services more than ever before. This comes from a growing need for convenient and relevant experiences. Insurance providers can leverage AI to tailor their services to unique individual needs. As a result, customers feel understood, which enhances their loyalty to the company.

- Omnichannel interactions are gaining relevance. Customers want to interact with their insurers through several channels. For instance, a customer on the move would prefer a quick chat via a mobile app. However, she might feel the need to have a detailed in-person interaction once she has enough time on hand. An omnichannel approach ensures that customers receive consistent service wherever they are.

- Customers appreciate intuitive self-service. The need for quick and seamless experiences has also given rise to the idea of self-service options. Digital tools like mobile apps, chatbots, and online portals are relevant here. These tools allow customers to complete tasks on their own without taking too much time.

- It’s important to think about risk mitigation. Customers are starting to embrace risk prevention and mitigation incentives. For instance, by offering safe driving discounts, your company can benefit by encouraging good habits. The safer your customers drive, the less likely you are to receive claims. Moreover, the discounts will prevent customers from seeking cheaper alternatives.

Examples of Insurance with the Best Customer Experience

Companies can achieve impactful business outcomes by delivering excellent customer experiences. The following insurance providers demonstrate the value of adopting a customer-centric approach:

Ohio Mutual Insurance Group

The Ohio-based insurance company maintained its competitive edge with a Voice of the Customer (VoC) program. It leveraged the Pearl-Plaza CX platform, especially its text analytics and case management features, for this purpose.

As a result, Ohio Mutual boosted its survey response rate to 25% and reduced survey response times from a few weeks to just a few days. Also, it captured analytical insights from feedback that provided a clearer picture of customer satisfaction levels.

A Fortune 500 insurance company

This P&C national insurance company had a clear goal: maintain a strong brand reputation to thrive in the competitive industry. Through their partnership with Pearl-Plaza, the insurance provider gained access to an intuitive and easy-to-use reputation management software. The decision was crucial to improving their public image to prospects.

Their average star rating increased by 8.7% from 4.48 to 4.87, while the review volume increased by a staggering 452%. The increased brand credibility enabled them to rise up the Fortune 500 list by 57 positions!

Allianz Trade

Allianz understood the importance of text analysis software in gaining a deeper understanding of customers. It partnered with Pearl-Plaza to add over 30 contextual data points to each piece of feedback.

The enriched data helped identify areas for improvement in issue resolution for frontline staff. As a result, Allianz witnessed a 5.7% and 6.7% growth in business and profit, respectively.

What are the best Customer Experience Metrics for Insurance Companies to Measure?

Once you’ve implemented your CX strategy, it’s imperative that you evaluate and measure its performance. Here are ten key metrics to help you see if your CX initiatives are delivering the expected returns:

- Customer Effort Score (CES): Measures how easy it is for customers to perform tasks like purchasing a policy, filing a claim, or resolving any inquiries.

- Claim Processing Rate (CPR): Tracks the speed at which you process insurance claims. A faster processing rate implies streamlined and efficient workflows that are likely to maintain or enhance customer satisfaction.

- Claim Denial Rate (CDR): Measures the percentage of claims you are rejecting. A higher rate, especially if it’s above the industry average, can result in increased customer dissatisfaction as policyholders will feel the insurance is not serving them according to their expectations.

- Customer Satisfaction Score (CSAT): Evaluates customer satisfaction with specific interactions like filing a claim or talking to customer support. A higher CSAT suggests that your CX initiatives are succeeding at resolving customers’ pain points.

- Average Time to Quote: Measure how quickly you provide a policy quote to customers once they provide their information. A faster response time enhances customer satisfaction and makes it likely that your company will be recommended to others.

- Average Time to Bind: Tracks the time needed to finalize a policy after a customer accepts the quote. Shorter times indicate that you are properly utilizing digital solutions like automation to streamline your workflows.

- Average Handling Time (AHT): Measures how long it takes to resolve customer inquiries, whether over the phone, via chat, or through email.

- Cross-Selling Rate: Measures how often existing customers purchase additional products or services, like adding home insurance to an auto policy. A higher rate implies a high level of customer trust in your brand, as they clearly find value in your offerings.

- Net Promoter Score (NPS): Evaluates customer loyalty by asking how likely customers are to recommend your insurance company to others. A high Net Promoter Score (NPS) suggests that your services and CX efforts are good enough to encourage positive reviews from customers.

- Policy Renewal Rate: Monitors the percentage of customers who renew their policies, reflecting how well you have fostered strong customer relationships.

Customer Experience Challenges in Insurance

A positive customer experience in insurance depends on overcoming obstacles like intense competition, fragmented journeys, and diverse preferences. Here’s a closer look at some of these challenges:

- Digital solutions fail to live up to customer expectations. While insurance customers appreciate apps and websites for their convenience, the current state of digital platforms leaves much to be desired. Clunky, slow, and difficult-to-understand digital channels are the reason why only 20% of customers rate them as their top choice for interactions.

- Customer journeys are fragmented from the beginning. There is a lack of cohesion in insurance customer journeys. Six out of ten customers switch channels before completing a purchase. Moreover, the transition between offline and online platforms tends to be sudden. These factors make it difficult for insurers to prioritize the right interaction channels.

- There is a strong customer need for interactions with human agents. Even the best digital systems can’t completely replace the human touch for insurance customers. Human agents are far better at handling complex issues like claims disputes and personalized advice. Therefore, it’s important for companies to maintain and train their workforce to this end.

- Customers have diverse channel preferences. The growing expectation for convenience means customers want to choose any communication channel at a given time. Without investing in an omnichannel approach, it will be difficult for insurers to fulfill this key demand.

- There is growing competition from big tech corporations. Tech giants like Google and Amazon are starting to enter the insurance space. Their resources allow them to offer innovative digital experiences and quick services. This growing competition puts pressure on incumbents to evolve and meet higher customer expectations.

How to Select the Right CX Software to Manage Insurance Experience

Insurance providers can streamline their customer experience management efforts by investing in intuitive and feature-rich CX software. Here’s what you should look for when selecting the right platform:

Omnichannel Feedback Collection

Customers interact with their insurers through multiple channels. This makes it crucial for companies to connect experience data from various sources. Pearl-Plaza’s CX integrations ensure you don’t miss out on any insights by integrating your platform with all the systems you use to collect feedback.

AI-Driven Text Analysis

AI empowers you to unlock meaningful information from volumes of feedback so you can make data-driven decisions. The award-winning AI text analysis software offered by Pearl-Plaza helps you automate the collection of analytical insights. As a result, you can save valuable hours that your workforce can invest in acting on the feedback itself.

Review Monitoring & Response Automation

The right CX platform should have features to monitor customer reviews across platforms such as Google, Yelp, or social media. Automating responses to these reviews helps manage your online reputation. It also shows customers you respond to them in real-time, enhancing satisfaction.

Pearl-Plaza’s platform allows you to generate review responses using AI. These responses can be set to adhere to specific brand guidelines to maintain a consistent tone across channels.

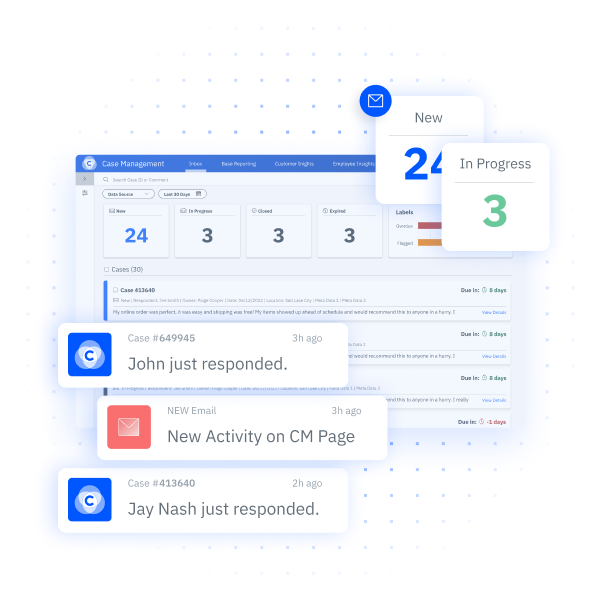

Case Management

It’s crucial to manage client concerns and issues to reduce complaints. This is where case management capabilities, such as the ones offered by Pearl-Plaza, can help. These features empower your agents to address customer needs and build long-term relationships.

Pearl-Plaza’s case management software simplifies the tracking of customer experience cases by allowing you to solve cases, identify larger trends, and quickly identify the root cause of a case based on customer and employee perspectives. This solution also recommends the most efficient way to solve cases, which empowers employees to handle issues promptly.

Compliance & Security

When selecting a customer experience software for your insurance organization, robust compliance and security are essential. Due to the sensitive nature of customer data, from health information to financial records, insurance companies must ensure that the software they select meets the requirements of strict data protection regulations. Considering this feature helps safeguard against risks while providing strong security protocols that protect your client’s privacy.

At Pearl-Plaza, we’re dedicated to safeguarding the confidentiality, integrity, and availability of our clients’ data; and our compliance programs reflect that. We’re committed to meeting and exceeding industry standards in regulatory compliance. Our platform is SOC 2 Type II compliant and ISO 27001 certified, and we’ve partnered with a hosting provider that adheres to Sarbanes-Oxley, HIPAA, and Gramm-Leach-Bliley regulations, ensuring that your program is protected by the highest standards in the industry.

Improve Your Insurance Customer Experience with Pearl-Plaza

Investing in excellent customer experience helps you win by boosting customer satisfaction. With Pearl-Plaza’s comprehensive CX platform, you can automate the collection and analysis of feedback so that your agents can spend more time focusing on what truly matters: fostering rich relationships with customers. Schedule a demo today to experience the transformative capabilities of our platform for yourself!

References

Insurtech Insights. Here’s How Google, Amazon, Facebook and Apple are Targeting the Health Insurance Market (https://www.insurtechinsights.com/heres-how-google-amazon-facebook-and-apple-are-targeting-the-health-insurance-market). Accessed 10/17/2024.

McKinsey & Company. Elevating customer experience: A win-win for insurers and customers (https://www.mckinsey.com/industries/financial-services/our-insights/insurance/elevating-customer-experience-a-win-win-for-insurers-and-customers). Accessed 10/17/2024.

Mendix. The Future of Insurance: 20 Stats That Show Customer Experience is Vital (https://www.mendix.com/blog/20-stats-future-insurance-depends-customer-experience). Accessed 10/17/2024.

Hi Marley. CONSUMER AND CARRIER CX INSIGHTS: What Drives 1-Star and 5-Star Customer Satisfaction Scores in Claims (https://www.himarley.com/wp-content/uploads/2022/03/Whitepaper-What-Drives-1-and-5-Star-Scores-In-Claims-1.pdf). Accessed 10/17/2024.