5 Tips For Choosing the Right Survey Rating Scale

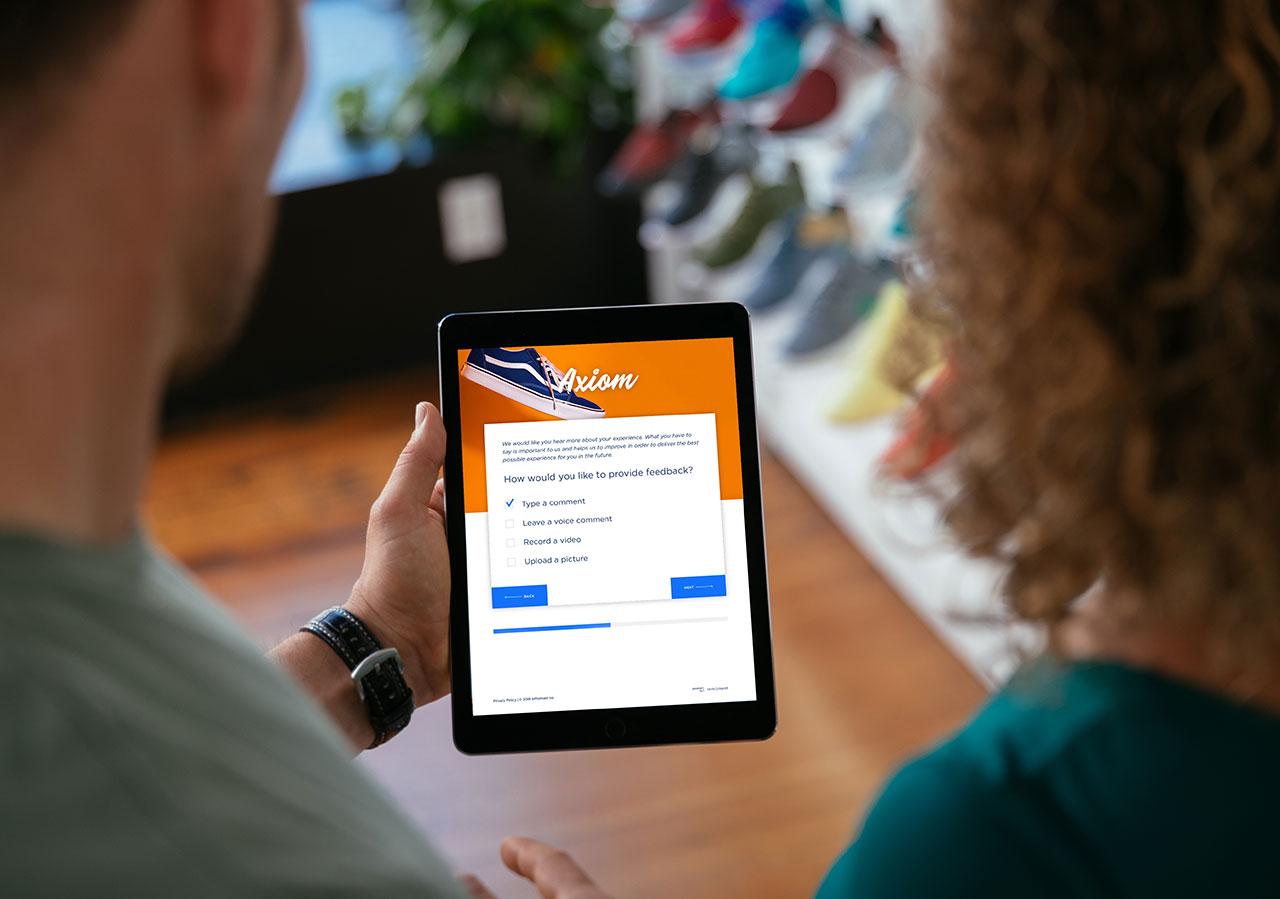

You’re sitting down to carve out the newest survey in your customer experience (CX) program. You know what touchpoint you’re examining, what you’re hoping to learn, and what questions you’re going to ask. Now it’s time to settle on the survey rating scale you’ll use.

Unsure of which scale to choose? I’m Kiri Burgess, a Senior CX Consultant at Pearl-Plaza APAC. Together, with our Director of Marketing Sciences, Sharon Allberg, in this post we’ll share with you a collection of best practice tips for using rating scales in your customer surveys

What Is a Survey Rating Scale?

If you’ve ever put together a customer survey, you will no doubt have used a rating scale as an option for respondents.

Survey rating scales are a way to ask a “closed question” to survey respondents, and collect valuable input in a quantitative way. Here’s an example:

There are a number of important considerations when using rating scales including:

- Number of scale points

- Anchoring of scale points

- Midpoints

- Colors and images

The choice of which survey rating scale to use can be perplexing. And while academic research is vast, it’s not always relevant to market or customer experience research, which can leave a number of unanswered questions.

Whatever scale you choose, the aim with a survey rating scale is to limit individual interpretation and ambiguity. In an ideal world, you want all respondents to view a scale in the same way.

Having reviewed scale literature and our own internal research; then overlaid client and research experience, here are five tips for survey rating scale success:

Here Are Five Pro Tips for Survey Rating Scale Success

Tip #1: Longer Scales Typically Reveal More Actionable Insight

There is not a great deal of evidence on the difference in performance between shorter (i.e. 5 point) or longer (i.e. 10 point) scales from a respondent point of view—but the advantage of a longer scale is you’ll get greater differentiation in response. Responses will be more spread out due to having a longer scale. This typically results in stronger driver analysis revealing more actionable insight.

Tip #2: Keep Survey Rating Scales as Consistent as Possible

If you can, decide on a rating scale size and stick with it throughout your survey. Greater scale consistency will not only make it easier for respondents but it also makes it easier to communicate what a good result looks like to the business as all questions will calculate ‘good’ the same way with the same scale points. We understand that this isn’t always straight forward so if you do change your scale in your survey, that’s okay. Our advice would be not to chop and change scale lengths multiple times which will cause respondents confusion and fatigue.

Tip #3: Label Your Scales Appropriately

How to best label your scale will depend on the scale length. For shorter 5 point scales, we recommend labeling each scale point for clarity. However, this isn’t an easy task for longer 10 or 11 point scales as you quickly run out of space (particularly on mobile devices!). Therefore for longer scales, we recommend labeling the end points only. Whatever scale you go for, labels should only be attached to the appropriate single scale point.

Tip #4: When It Comes to Mid Points, Assess On a Case-by-Case Basis

Researchers like to include mid points for respondents who are undecided.

There is some evidence that neutral respondents will answer randomly if they don’t have a neutral option to pick; however, this point-of-view comes from the world of public policy research. Therefore, at Pearl-Plaza we recommend a case-by-case approach and to include a midpoint if it makes sense. With satisfaction or agreement scales, it is more common to use a midpoint.

Tip #5: Avoid Scale Colors and Images

Research has shown that coloring scales (even shades of gray) or adding images or icons (including smiley faces) is not recommended, as this leads to scales being inconsistently interpreted by respondents. Examples include colors being an issue for those who are color blind; and images, icons and smiley faces having different meaning for everyone, particularly those who are neurodiverse (which is estimated at 15-20% of the population).

There you have it—five best practices to help you avoid bias, optimise your surveys, and collect the most actionable insights possible. To learn more about best practice surveys, check out this paper on Transactional Customer Experience Survey Best Practices.