Collecting data with no way to use it is like learning to drive without a car; it just doesn’t make sense. For retail banks, and most organizations, collecting data is only half the battle in the world of customer experience. Whether it be transactional surveys, online reviews, or a market research report about your customers, the data you collect needs to not just be analyzed, it needs to serve as a road map of future business decisions.

Using customer data to influence your business decisions will lead to a more streamlined, profitable banking organization that actively engages customers. Don’t just take our word for it, research shows that companies who adopt data-driven marketing are six times more likely to be profitable year-over-year.

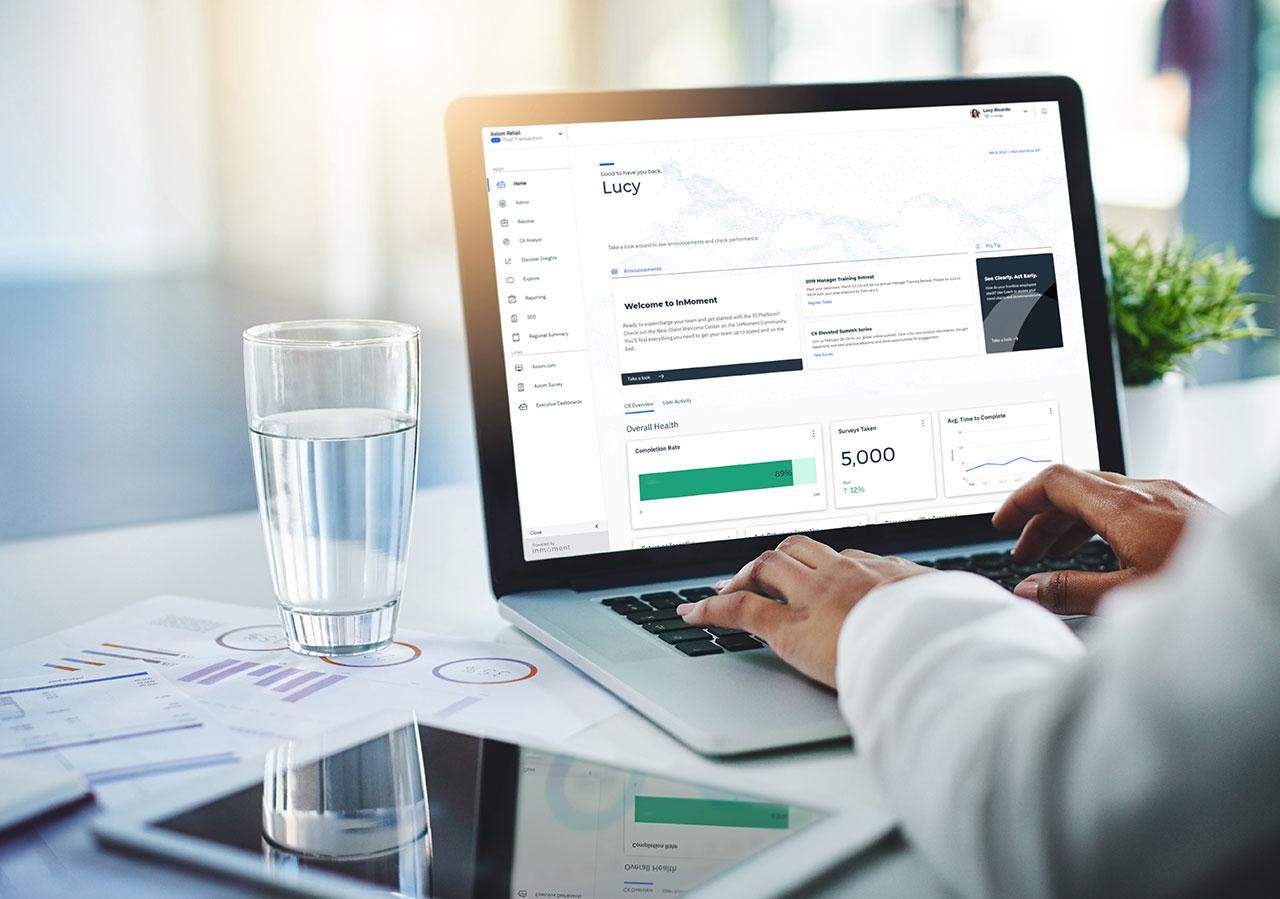

Every day, your customers produce data across a vast amount of touchpoints, whether that’s on your banking app, in your call center, or across any of your other channels. That data is there to help you understand their behavior, their needs, and even predict their future behavior. But, in order to do this, that data has to be in a centralized platform in order to be readily available for evaluation and future strategic planning.

Once you have this data at your disposal, there are a number of ways you can use it to improve experiences for your banking customers. With so many ways to use customer data, we have picked 5 strategies for retail banks looking to leverage customer data.

5 Strategies for Retail Banks to Get the Most Out of Their Customer Data

Strategy #1: Capture Meaningful Data

You need to capture data that is meaningful to your bank, and that is related to the current objectives you have in mind. If you run a local credit union, there’s no point in asking your members what their favorite flavor of ice cream is. This is a more extreme example, but you get what we’re trying to say. If your goal is to improve the digital experience, you don’t want to ask about the in-branch experience.

By designing an experience program with your end goals in mind, you’ll know what data you need to collect to achieve those goals. Knowing what data you need to collect will outline what questions you need to be asking your customers in order to get that data, and consequently, achieve those goals you originally planned.

Retail banks already have access to critical customer data. Age, gender, geographic location, and spending habits are data points that can already be leveraged. But, mixing these data points with structured feedback via social media or surveys, as well as meaningful data captured in order to achieve a desired goal, will allow retail banks to get a holistic view of their customer and their customer experience.

Wondering how you can refine your data-gathering strategy to leverage the right listening methods at the right time? Check out this quick article.

Strategy #2: Master Omnichannel Experiences

Retail banking customers today demand consistent, intuitive omnichannel experiences that are personalized and accessible anywhere. However, most retail banks fail to deliver this and are unable to monetize customer data through their products and services.

Research shows that online banking has increased by 23% and mobile banking has increased by 30%. This means that customers are stepping away from the teller, and toward the chat assistant on your bank’s website or app. Although the medium is changing, customers still expect the same experience that they received inside a branch to be consistent with the one they receive online.

By mastering omnichannel experiences, you will set yourself apart from the competition, and keep your customers coming back time and time again, whether they are on their phone, computer, or visiting you in person.

Strategy #3: Break Down Data Silos

Breaking down data silos and combining data from multiple sources across a banking organization can increase efficiency and control in a fast-changing and demanding environment.

Retail banks receive data from multiple sources and departments. If these various pathways of customer data do not converge on a central location, retail banks risk having a distorted view of the customer experience and risk an increase in customer churn.

By having all of your customer data in one place, you can easily access multiple data points from different locations across your organization. This will provide you with a 360-degree view of a customer’s activity and engagement with the bank and will allow you to make well-informed decisions with your customer base in mind.

Strategy #4: Collect Data Across the Entire Customer Journey

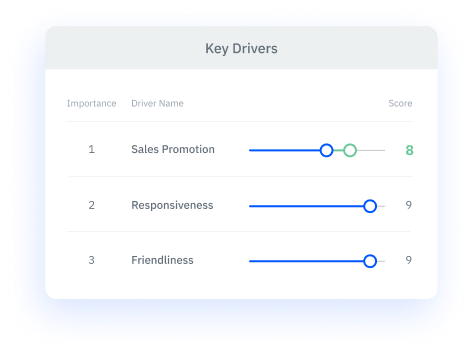

Retail banks can achieve their goals by tracking the customer journey, and finding areas of improvement. When doing this, it is important to track the entire customer journey. While a traditional bank may track the customer journey as opening an account, transactions, and borrowing, you should be tracking the steps it took for a customer to open an account, such as their first visit to your website. Where other banks track transactions, you should track specific spending habits in order to know your customer and personalize their experience.

Retail banks must keep the customers at the heart of the journey by tracking key moments in their experiences and improve these moments in the customer journey.

Strategy #5: Analyze Behavior and Emotions

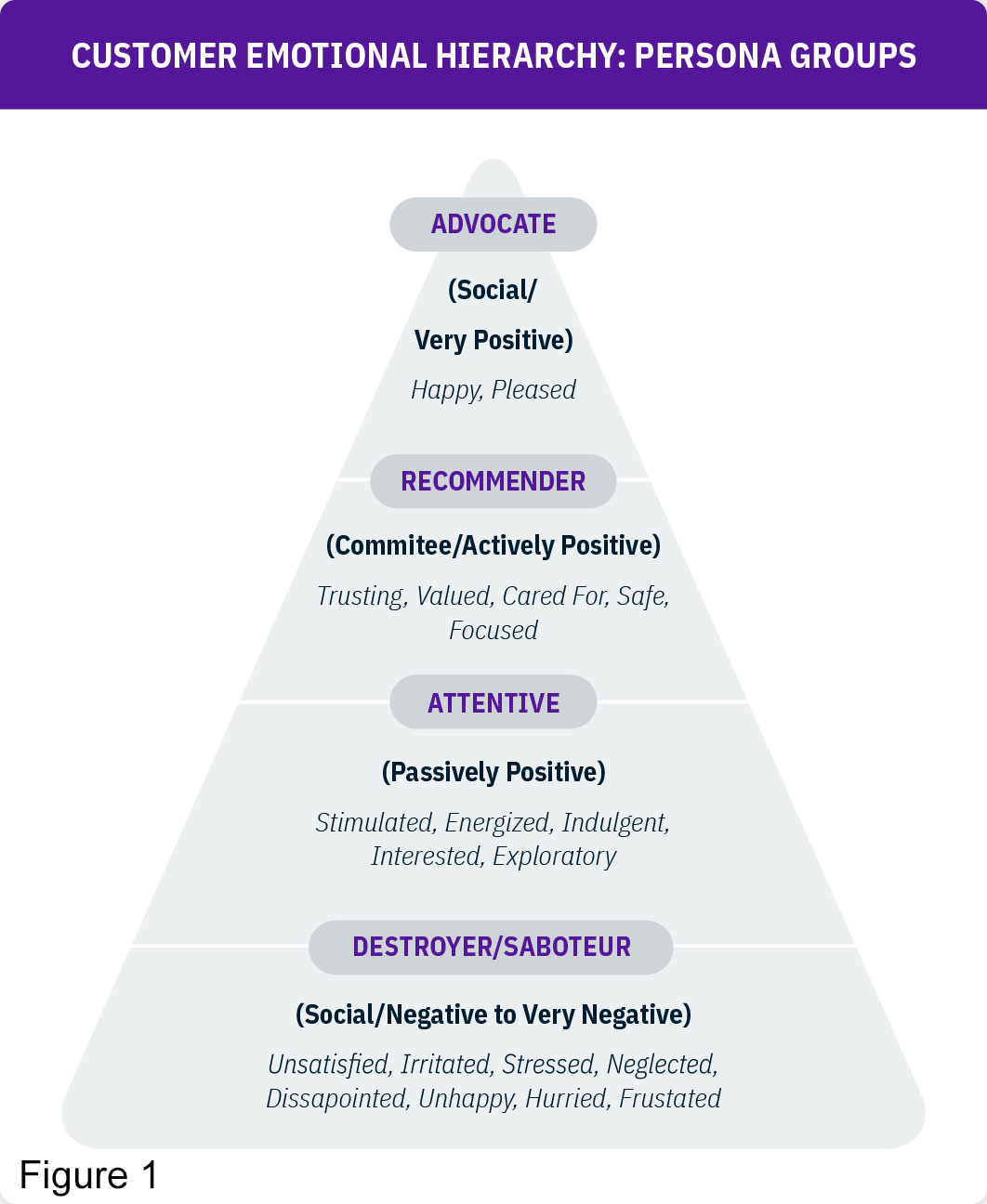

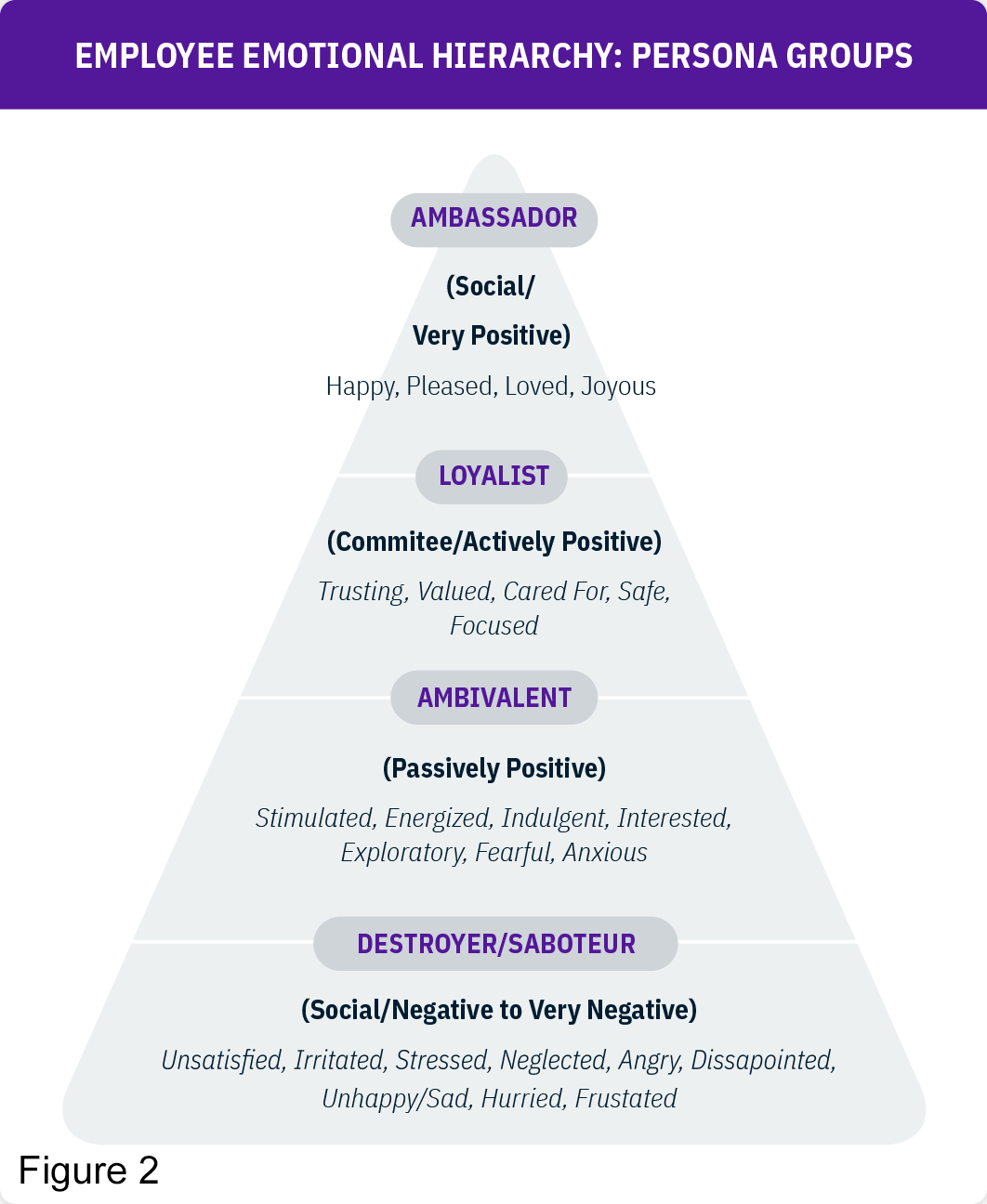

Throughout the data collection process, it is important to remember that your customers cannot be reduced to just a mix of data points. Your customers have emotions, and they make emotional decisions. Without cultivating positive emotions in customers, banks risk being forgotten. You need to know your customers behavior, so that you know where to focus to make the biggest impact on them.

According to J.D. Power, Customers in the retail banking industry are not happy with the level of personalization they experience in their transactions—but the customer feedback you collect could help change all that! Designing experiences to create positive emotions increases customer lifetime value and reduces risk of customer churn. Learn how retail banking giant Virgin Money analyzed customer emotions across the journey to create specific improvements and positive emotions in this video!

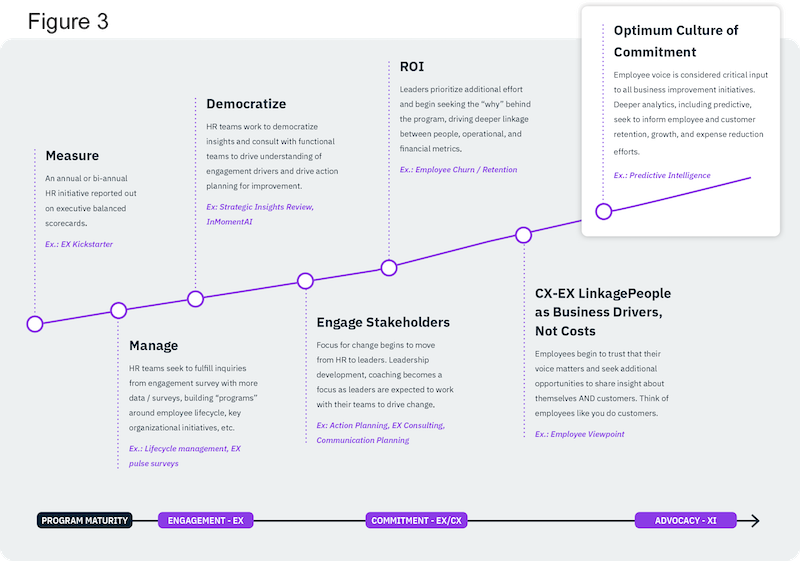

Leveraging Your Customer Data

Your customer data should be one of your biggest assets. It can be used to solve problems, and make decisions with your customers’ needs in mind. But remember, data alone cannot make those changes—you need to make sure you’re leveraging the right technology, taking the advice of experts, and taking action based on the insights you derive from that data. Put in place a framework that ensures that type of continuous experience improvement, and you are sure to attract new customers, retain old ones, and, ultimately, make your customer experience program a key part of your retail bank’s success!

For more information about how retail banks can leverage customer data effectively, checkout this white paper on how to stand out in your industry!