When it comes to collecting feedback, of course we want to hear what our actual customers have to say about their experience. But, what about those individuals who have yet to make a purchase? Without a transaction, these non-purchasers won’t receive an invitation to take a survey—but, their experience is just as important to listen to and understand. In fact, non-purchaser feedback can offer you additional perspective that you wouldn’t get otherwise.

Non-purchaser feedback is valuable for many reasons—it can help point your brand to the reasons why customers might not be completing transactions as well as help you discover critical experience gaps in the customer journey.

Here are three customer experience (CX) solutions you can use to connect with and understand the experience of non-purchasers:

Solution #1: Use a Digital Intercept on Your Website

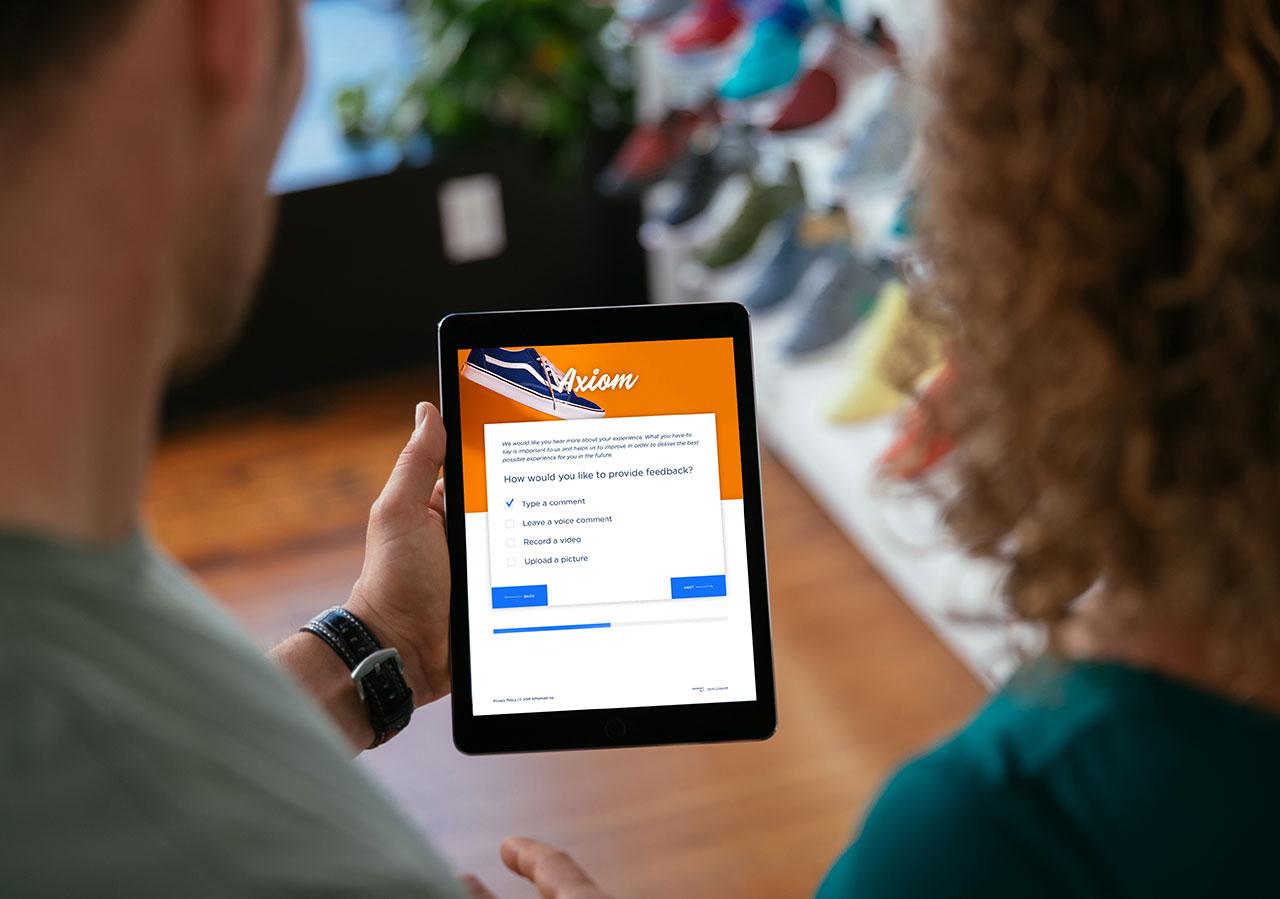

One of the most prominent solutions is to use digital intercepts on your website. An example of this is Foot Locker—this retail brand uses an ‘always on’ listening tab on their homepage that collects feedback from both customers and non-purchasers.

When it comes to connecting with customers that haven’t completed a purchase, digital intercepts are a creative solution for collecting feedback. For example, Foot Locker uses a web survey that pops up in an iframe after customers browse for more than five minutes, if they abandon their cart items, or if they return using the same IP address multiple times without completing a transaction.

These are all opportunities to engage with your customers and better understand their experience, allowing you to better inform your business on what actions need to be taken to improve these experiences—and improve conversation rates.

Solution #2: Encourage Employees to Invite Non-Purchasers to Participate

Because the employee experience (EX) is tied so closely to the customer experience (CX), of course we recommend to involve your frontline staff as much as possible in your overall CX program. These employees can be your greatest asset when it comes to connecting with non-purchasers.

Many retailers use posters throughout the store to encourage feedback, and others will hand out QR codes on cards to shoppers if they leave empty handed. Simply asking staff to promote the feedback program to both customers and non-purchasers will boost the volume of feedback and insights for your business, and help you understand more about the in-store experience gaps and opportunities to improve.

Having a CX program that incorporates the voice of employee is a modern day ‘must’. Make sure you have an easily accessible channel for your employees to share the feedback that they are hearing from customers each day. It is far too valuable to ignore!

Solution #3: Consolidate Your Solicited Customer Feedback with Your Unsolicited Social Feedback

Let’s face it, 80% or more of the customer feedback you’ll collect will come from customers, people that have made one or many purchases from your brand. A channel that is already rich in non-purchaser feedback is social. There are loads of reviews that exist today about your brand, about your website, or about the in-store experience that a non-purchaser has already shared. If you are reading and acting on these already, that’s terrific.

The next step is then to consolidate all this rich non-purchaser feedback into your broader CX program. Having all your feedback in one location improves your level of understanding, broadens the range of customers you’ll hear from and leads to much clearer decision making across the whole of your business.