Digital experience trends are the new road maps of modern day business. Are you still using a paper map to direct you when you’re driving to work? Of course not, you’re using your smartphone that tells you where you are, when to turn, and if there is an accident up ahead.

Think of digital experience trends being the new maps application in your business. You aren’t waiting until the end of the year to get a mailed report containing consumer trends for the past year (hopefully), but rather you need to be keeping up with your consumers in real time. Identifying digital experience trends will help you adapt your business to get ahead of your consumer, not behind them.

It’s no understatement that you—along with every other business for that matter—are operating completely differently than you did in 2019. The COVID-19 pandemic has changed the way that businesses, well, do business. It has also changed the way that your customers interact with you.

Whether it be a customer, prospect, or non-buyer, every piece of the customer journey looks differently today than it did before the pandemic, particularly when it comes to the digital experience. Businesses have been forced into being digital-first. If you didn’t already have a digital presence, you were forced to adopt one, seemingly overnight. And post-COVID, if you haven’t already built a digital experience strategy, we hate to break it to you, but you’re already behind the buck.

Today’s customers aren’t going to be wooed by you just having digital options—they want you to supply truly innovative digital experiences. In other words, you don’t want to follow the digital experience trends, you want to be able to create them so your customers follow you. To help you out, our experts have pulled together a plan to help you mine the data that is going to help you uncover, and take advantage of new digital trends. Tune in below!

3 Steps to Start the Next Digital Experience Trend

- Build a Strong Foundation with Integrated Experience

- Strategize New Customer, Employee, & Non-Buyer Signals

- Don’t Settle for Snapshots—Aim for Actionable Intelligence

Step #1: Build a Strong Foundation with an Integrated CX Approach

Your customers are talking about your business across multiple different channels. Whether it be directly to you (via surveys) or indirectly (through review sites, social media, and the like), your customers are creating signals throughout their journey. However, most CX platforms are still primarily focused on surveys and traditional metrics (in blue in the figure below).

In order to be successful, it is important to have a CX vendor that enables you to do more than take a traditional approach to feedback. We refer to our modern approach to experience as an Integrated CX approach.

As you can see in the figure below, Integrated CX takes into account all the new signals customers are sending and houses them in one place, the Pearl-Plaza XI Platform. Having a central location for all your customer data helps create a clearer, more consistent picture of the customer journey, empowering you to make more informed, data-backed business decisions in the future.

Step #2: Strategize New Customer, Employee, & Non-Buyer Signals

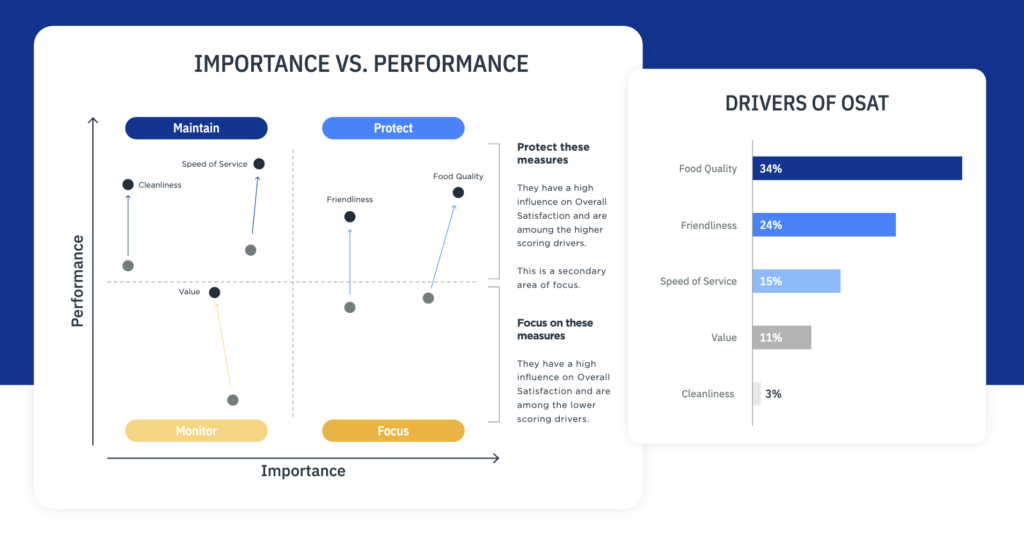

Gathering data in today’s business environment is easier than ever before. But, the challenge lies in gathering data and linking it to meaningful business KPIs such as customer loyalty, customer acquisition, or generally proving program ROI.

Below, you can see a graphic that illustrates the different feedback signals available today, and how they can be funneled into the XI Platform, then, leveraging the expertise of our Strategic Services Team and AI-Driven technology, you can go from just tracking metrics and scoreboard watching to using that data to uncover actionable insights that create meaningful improvement.

Step #3: Don’t Settle for Snapshots—Aim for Actionable Intelligence

When you export data out of a platform to analyze it, it is already somewhat outdated. Especially when considering the rapid evolution of social-based interactions, even data from the previous quarter might not accurately reflect how your customers are behaving.

In order to get a better understanding of how your customers work, what they are looking for, and what the next digital trend might be, you need to be getting your data in real time in order to keep up with the fast-paced digital landscape and start the next digital experience trend.

Sounds like a fairytale? Well, to prove to you that it’s possible to have always-on, real-time insights, we leveraged the XI Platform to pull over 120,000 data points across the retail industry over the course of seven days using Pearl-Plaza’s Integrated CX approach. From this data, we unearthed the following three actionable insights that you can use going forward:

- 1 of 3 emerging customers are more likely to interact with you through social signals, than traditional surveys

- 60% of those customers have purchased/adopted a new product or offering via a social signal

- 1 of 2 customers are likely to select a brand that offers a “one-stop” solution, with additional incentives and features (such as buy now, pay later)

Once you have these insights, you are able to empower teams across your business to make informed business decisions and implement customer-pleasing digital experience trends. And once you act on the intelligence, you’ll be able to point back to your experience program as the catalyst to success.

Thinking Outside the Survey

Don’t feel pressured to do things the way they have always been done. As a matter of fact, if the history of social channels have shown us anything, it’s that you need to be willing to try something different in order to succeed.

You’ll never fully understand your customers by just sending them surveys. But, if you interact with them through various social channels, you may be able to get a clearer picture of who they are, and what they want from you.

Want to learn more about understanding your customers, and how to kickstart the next digital trend? Watch the full presentation here!