Building an Omnichannel Customer Experience in Retail

Find out how to ease call center pressure with CX-friendly tactics that deflect volume, improve satisfaction, and streamline operations.

Retail customers today expect more than transactions; they demand experiences that seamlessly connect every touchpoint of their journey. Whether browsing on mobile during their commute, researching products online at home, or visiting your physical store, customers want consistency, convenience, and personalization at every step. The brands that master this integrated approach don’t just satisfy customers; they build loyalty that drives sustainable growth.

It used to be that retailers considered the four “P’s” of marketing when pushing their wares to consumers: product, price, promotion and place. Today, however, not many brands can rely on a single “P” to differentiate, but are instead dependent on one big “E:” experience. Building an omnichannel customer experience in retail isn’t just a competitive advantage; it’s essential for survival in today’s market where customers have unlimited options and sky-high expectations.

What Is an Omnichannel Retail Experience?

An omnichannel retail experience integrates all customer touchpoints (online, mobile, in-store, social media, and customer service) into one cohesive, seamless journey. Unlike multichannel approaches that operate touchpoints in silos, omnichannel creates a unified ecosystem where customers can move fluidly between channels without friction or inconsistency.

This means a customer can research a product on your mobile app, add it to their cart, visit your store to try it on, complete the purchase online, and return it at a physical location (all while receiving consistent messaging, pricing, and service quality). The experience feels effortless because behind the scenes, all systems, data, and teams work together to support the customer’s preferred way of shopping.

Why Is Omnichannel Retail Important for the Customer Experience?

Omnichannel retail transforms convenience from a nice-to-have into a foundational expectation. According to recent research, 73% of customers use multiple channels during their shopping journey, and companies with strong omnichannel strategies retain 89% of their customers compared to 33% for those with weak strategies. Additionally, omnichannel shoppers deliver 30% higher lifetime value than single-channel customers.

The approach improves customer experience by meeting customers wherever they are in their buying journey. Instead of forcing customers to adapt to your preferred channels, omnichannel customer experience lets them choose how, when, and where they want to engage. This flexibility creates deeper personalization opportunities, as each interaction across channels provides data that enhances the overall experience.

Customers also value the reduced effort that comes with omnichannel experiences. When inventory, preferences, and purchase history are synchronized across all touchpoints, customers spend less time repeating information and more time enjoying seamless, efficient interactions that respect their time and preferences. Research shows that omnichannel marketing campaigns achieve 287% higher purchase rates than single-channel campaigns.

Who Should Own Omnichannel Customer Experience Within the Business?

Creating effective omnichannel experiences requires cross-functional ownership that breaks down traditional organizational silos. While customer experience (CX) teams often lead the strategic vision and measurement, successful implementation demands collaboration across marketing, product, operations, IT, and customer service departments. Retail customer experience success depends on this unified approach.

The most effective approach establishes a dedicated omnichannel team with representatives from each key function, led by a senior executive who can drive alignment and remove barriers. This team should include CX managers who understand customer journey mapping, marketing leaders who control messaging and brand consistency, operations managers who handle inventory and fulfillment, and IT specialists who ensure technical integration.

Customer Experience and Insights Managers typically own the measurement and optimization of the experience, using feedback tools and analytics to identify improvement opportunities. However, without buy-in and active participation from every department that touches the customer, even the best CX strategy will fail to deliver the seamless experience customers expect.

What Makes an Effective Omnichannel Customer Experience?

Effective omnichannel experiences share five critical elements that work together to create seamless customer journeys. First, channel integration ensures all touchpoints communicate with each other in real-time, sharing customer data, inventory levels, and interaction history to prevent frustrating disconnects. Studies indicate that 74% of consumers research online before visiting physical stores, making this integration essential.

Unified customer data forms the foundation, creating a single source of truth about each customer’s preferences, behaviors, and history that every channel can access and update. This eliminates the need for customers to repeat information and enables personalized experiences regardless of how they choose to engage.

Consistency across all touchpoints—from visual branding to pricing to service quality—builds trust and reinforces brand recognition. Customers should feel they’re interacting with the same company whether they’re on your website, in your store, or speaking with customer service.

Personalization leverages unified data to tailor experiences based on individual customer preferences, purchase history, and behavior patterns. This might include personalized product recommendations, relevant offers, or customized communication preferences. Research demonstrates that 80% of customers are more likely to purchase when they receive personalized choices.

Finally, seamless handoffs between touchpoints ensure customers can start an interaction in one channel and continue it in another without losing context or momentum. Whether moving from online browsing to in-store purchase or from chat support to phone support, the transition should feel natural and effortless.

How to Build an Omnichannel Retail Experience Step by Step

Building a successful omnichannel retail experience requires a systematic approach that prioritizes customer needs while ensuring operational efficiency. The following steps provide a roadmap for creating experiences that truly connect every touchpoint in your customer’s journey.

1. Segment Your Customers and Build Personas

Understanding your customers forms the foundation of every effective omnichannel strategy. Start by analyzing customer data to identify distinct segments based on demographics, shopping behaviors, channel preferences, and purchase patterns. Look beyond basic information to understand motivations, pain points, and decision-making processes.

Create detailed personas for each key segment, including their preferred channels, typical journey paths, and specific needs at different stages. For example, busy professionals might prioritize mobile-first experiences with quick checkout options, while product enthusiasts may prefer detailed online research followed by in-store consultations. These personas will guide channel prioritization, messaging strategies, and experience design decisions.

2. Select and Prioritize Your Channels

Not every channel deserves equal investment. Analyze where your target customers actually spend their time and prefer to engage, then focus resources on optimizing these high-impact touchpoints. Consider both current usage patterns and emerging trends that might affect future preferences.

Prioritize channels based on customer preference, business impact, and your ability to deliver excellent experiences. A boutique retailer might focus on Instagram, email, and in-store experiences, while a large electronics retailer might prioritize mobile apps, physical stores, and customer service chat. The key is doing fewer channels exceptionally well rather than spreading resources too thin across every possible touchpoint.

3. Map and Analyze the Full Customer Journey

Create comprehensive journey maps that trace every interaction customers have with your brand, from initial awareness through post-purchase support. Include all touchpoints—paid advertising, social media, website visits, store interactions, customer service contacts, and follow-up communications.

Identify pain points, friction, and opportunities at each stage. Pay special attention to moments when customers transition between channels, as these handoffs often create the most frustration. Use this analysis to prioritize improvements that will have the biggest impact on customer satisfaction and business results.

4. Unify and Integrate Customer Data Across Channels

Create a single, real-time view of each customer by connecting data from all sources—online behavior, in-store purchases, mobile app usage, customer service interactions, and beyond. This requires integrating your technology stack, including customer relationship management (CRM) systems, point-of-sale (POS) systems, inventory management, and customer service platforms.

Invest in customer data platforms (CDPs) or similar technologies that can consolidate information from multiple sources and make it accessible across all channels. Ensure data flows in real-time so that a customer’s online cart is visible to in-store associates, purchase history informs customer service interactions, and preferences gathered in one channel enhance experiences in others.

5. Ensure Consistent Branding and Messaging

Maintain a unified brand voice, visual identity, and messaging strategy across every channel and touchpoint. This consistency builds trust and reinforces brand recognition, making customers feel confident they’re receiving the same quality experience regardless of how they choose to engage.

Develop comprehensive brand guidelines that cover visual elements, tone of voice, key messaging, and service standards. Train all customer-facing teams on these standards and implement approval processes to ensure consistency. Regular audits across all channels help identify and correct inconsistencies before they impact customer perception.

6. Offer Seamless Cross-Channel Experiences

Implement features that make it easy for customers to move between channels without losing momentum. Buy online, pick up in store (BOPIS) services let customers combine the convenience of online shopping with the immediacy of in-store pickup. Over 80% of retailers plan to implement BOPIS services by 2025, and 67% of customers make additional purchases during pickup visits. Easy returns across any channel reduce friction and build confidence in the purchase decision.

Ensure pricing consistency across all channels to prevent customer confusion and maintain trust. Reserve online, try in store programs let customers secure products online before visiting to make final decisions. These cross-channel capabilities should feel natural and effortless from the customer’s perspective.

7. Provide Real-Time Inventory Visibility and Consistency

Enable customers and staff to see accurate, up-to-date inventory across all channels to prevent disappointment and build confidence in your brand. Nothing frustrates customers more than finding a product online only to discover it’s unavailable for their preferred pickup or delivery method.

Implement inventory management systems that sync across all channels in real-time. Train staff to access and communicate inventory information accurately, and ensure your website and mobile app reflect true availability. Consider offering alternatives when preferred items are unavailable, such as suggesting similar products or different fulfillment options.

8. Invest in Omnichannel Customer Support

Deliver knowledgeable, consistent support across all channels (phone, chat, email, social media, and in-store) to resolve issues quickly and maintain satisfaction. Customers shouldn’t have to explain their situation repeatedly when moving between support channels. Omnichannel contact center strategies ensure seamless support experiences.

Implement unified customer service platforms that give agents access to complete customer histories and previous interactions regardless of channel. Train support teams on all products and services, and establish clear escalation procedures. Consider offering self-service options through FAQs, chatbots, and knowledge bases for customers who prefer to resolve issues independently.

9. Leverage Mobile and In-Store Technology

Enhance experiences with mobile apps, QR codes, digital kiosks, and other technologies that bridge the gap between digital and physical shopping. Mobile apps can provide personalized experiences, store locators, inventory checking, and exclusive offers that complement in-store visits.

In-store technology like digital kiosks can provide access to extended inventory, product information, and customer reviews. QR codes can link physical products to online reviews, detailed specifications, or how-to videos. The goal is using technology to enhance rather than complicate the shopping experience.

10. Create a Unified Loyalty Program

Design a rewards system that works seamlessly across all channels, encouraging engagement and repeat business wherever customers shop. Points earned online should be redeemable in-store, and vice versa. Loyalty program benefits should enhance rather than complicate the omnichannel experience.

Ensure loyalty data integrates with your customer data platform to enable personalized offers and communications. Consider tiered programs that reward different types of engagement, from social media sharing to product reviews to referrals. The program should feel valuable and relevant to customers’ actual shopping behaviors.

11. Prioritize Security and Data Privacy

Protect customer data and ensure compliance with privacy regulations as you unify and leverage information across platforms. Customers need to trust that their personal information, purchase history, and preferences are secure regardless of how they choose to engage with your brand.

Implement robust security measures across all systems and touchpoints. Be transparent about data collection and usage, and give customers control over their privacy preferences. Regular security audits and staff training help prevent breaches that could damage customer trust and business reputation.

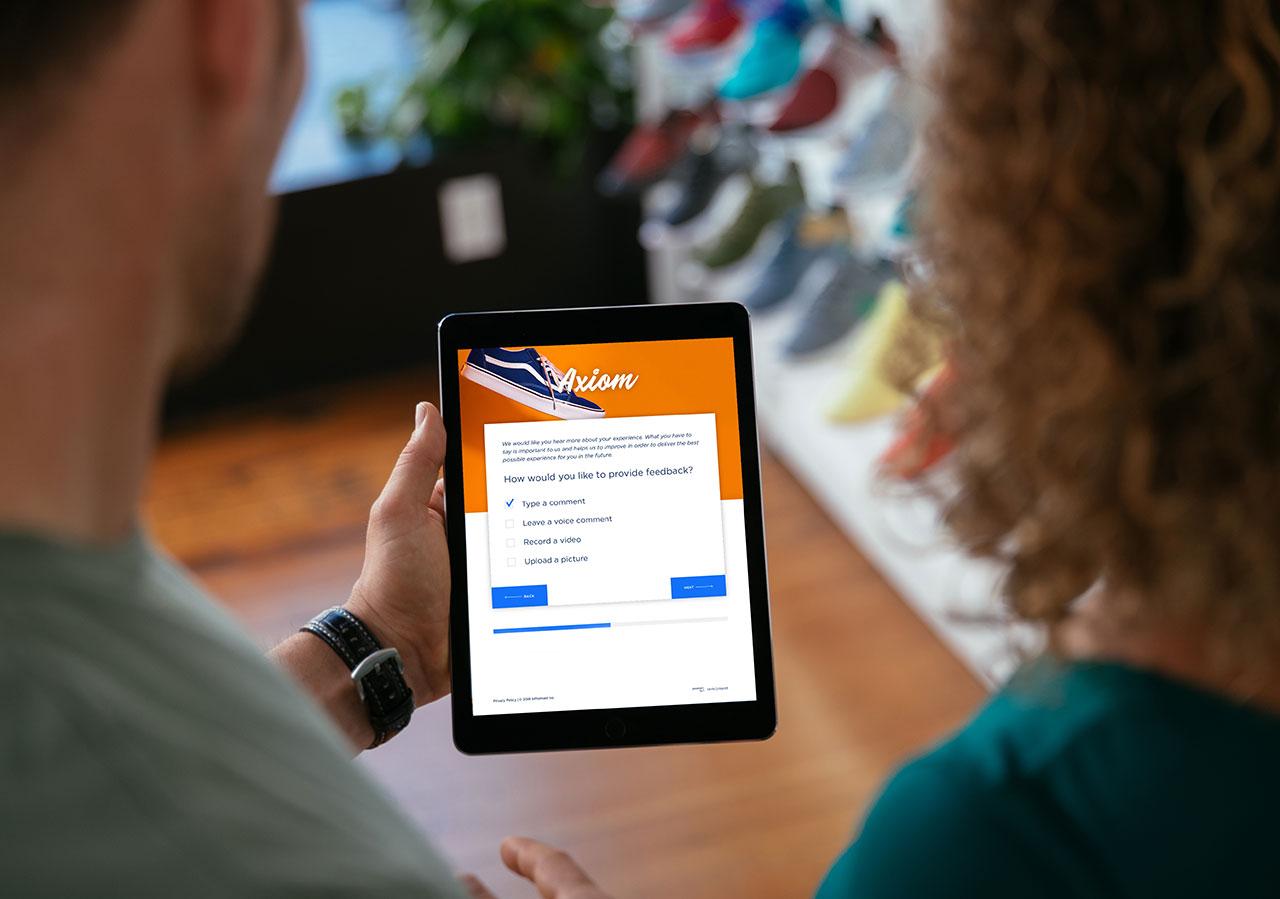

12. Gather and Act on Customer Feedback

Collect feedback at every touchpoint and use it to continuously improve your omnichannel experience. This includes post-purchase surveys, in-store feedback, social media monitoring, and customer service interaction analysis.

Implement systems that can aggregate feedback from all channels to identify patterns and improvement opportunities. Share insights across teams and establish processes for acting on customer suggestions. Close the loop by communicating improvements back to customers, showing that their feedback creates real change.

13. Automate, Test, and Optimize

Use automation like chatbots, triggered email communications, and personalized recommendations to enhance efficiency while maintaining personal touches. AI-powered solutions are transforming retail operations, with 69% of retailers reporting increased annual revenue from AI adoption. Implement ongoing testing through A/B testing, analytics, and customer journey analysis to refine every aspect of your strategy.

Set up measurement frameworks that track key performance indicators across all channels, including customer satisfaction scores, conversion rates, average order values, and customer lifetime value. Regular optimization based on data and testing ensures your omnichannel experience continues improving over time.

How Can Technology Enhance the Omnichannel Retail Experience?

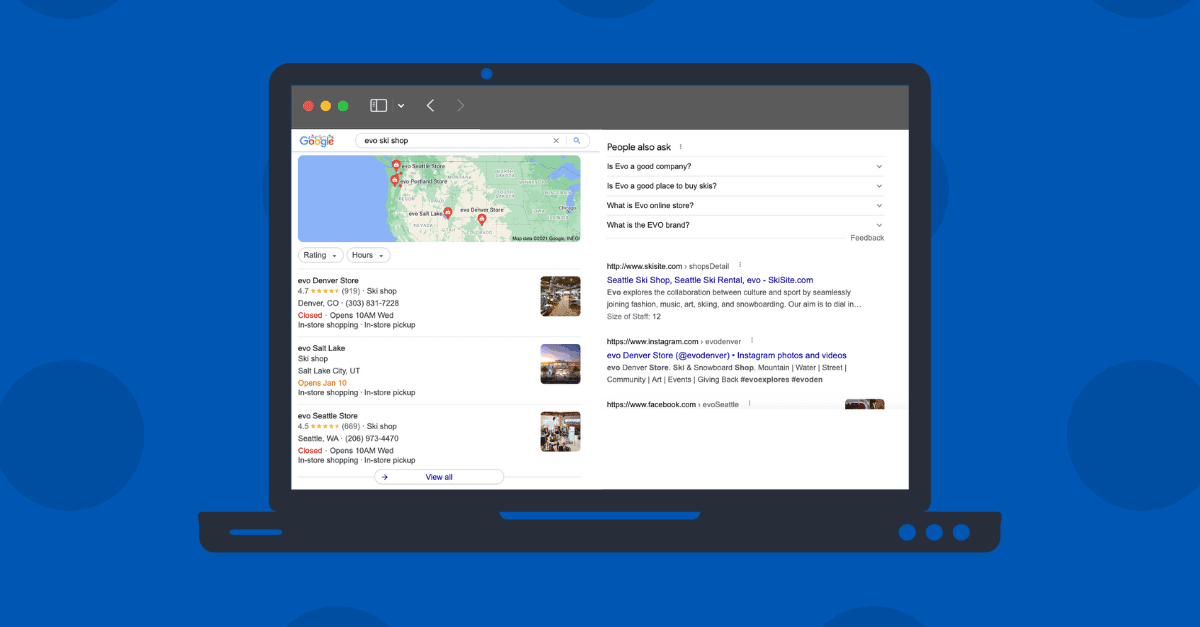

Technology serves as the backbone that makes seamless omnichannel experiences possible. Integrated customer feedback tools provide real-time insights into satisfaction levels across all touchpoints, enabling quick responses to issues before they escalate. These platforms can automatically collect feedback through email surveys, in-app prompts, and post-interaction questionnaires while providing unified reporting across all channels.

Sentiment analysis technology monitors customer conversations across social media, reviews, and customer service interactions to identify trends and emerging issues. This proactive approach lets retailers address problems before they impact the broader customer base and identify opportunities for experience improvements. Recent industry data shows that 86% of retailers want to use generative AI to enhance customer experiences.

Cross-channel experience management platforms tie together customer data, interaction history, and feedback to create comprehensive views of each customer’s journey. These solutions enable personalized experiences by predicting customer needs, identifying the best channels for engagement, and ensuring consistent treatment regardless of touchpoint.

Advanced analytics and artificial intelligence can predict customer behavior, optimize inventory placement, and personalize marketing messages based on individual preferences and past interactions. The AI in retail market is projected to grow from $9.36 billion in 2024 to $85.07 billion by 2032, demonstrating the technology’s critical role in retail transformation. Machine learning algorithms continuously improve recommendations and experiences as they process more customer data.

Create an Omnichannel Experience for Retail Customers With Pearl-Plaza

Building a truly seamless omnichannel retail experience requires more than good intentions and disconnected tools—it demands an integrated approach that unifies customer data, feedback, and insights across every touchpoint. The retailers that succeed understand that omnichannel isn’t just about having multiple channels; it’s about creating connected experiences that anticipate customer needs and deliver consistent value wherever customers choose to engage.

Pearl-Plaza’s integrated CX platform helps retailers achieve this vision by connecting customer feedback, sentiment analysis, and experience management across all channels. Instead of managing separate tools for surveys, reviews, and customer service insights, retailers can access a unified view of customer sentiment and behavior that drives better decisions and more personalized experiences.

Ready to transform your retail customer experience with a truly integrated omnichannel approach? Discover how Pearl-Plaza can help you build seamless experiences that drive loyalty and growth.