Data is gold. Data is truth… but data is useless if you can’t rely on it.

Understanding customer and employee sentiment is more than just a competitive edge—it’s essential, with companies in every industry and sector focusing resources on comprehending it.

We have a revolutionary tool that we’d like to share, one that has helped businesses large and small navigate this space. Pearl-Plaza Advanced AI turns diverse data streams into valuable insights companies can use for their strategy. It’s been the change clients in various fields have relied on. So for starters…

What is Pearl-Plaza Advanced AI??

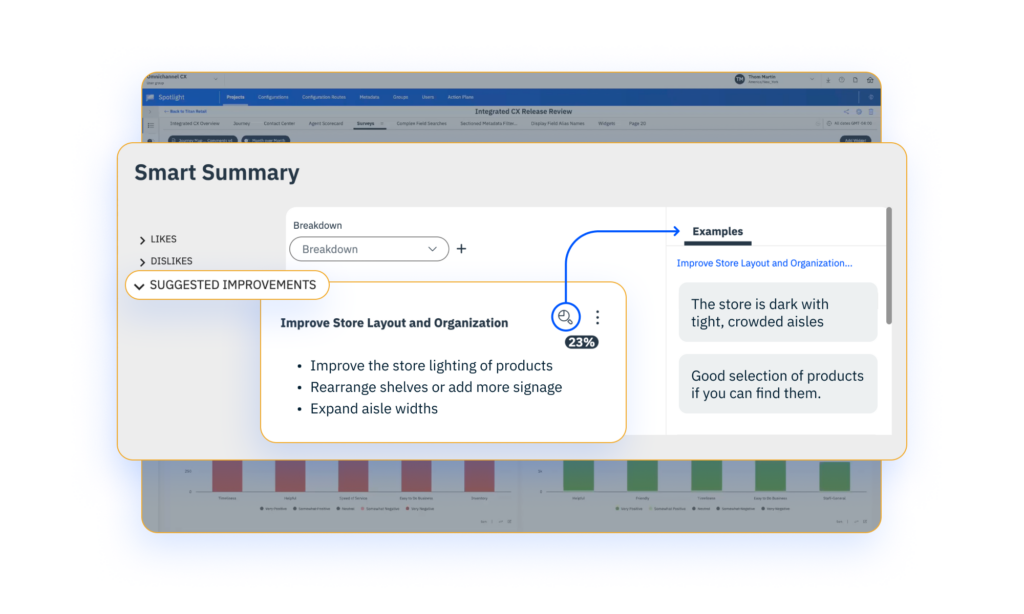

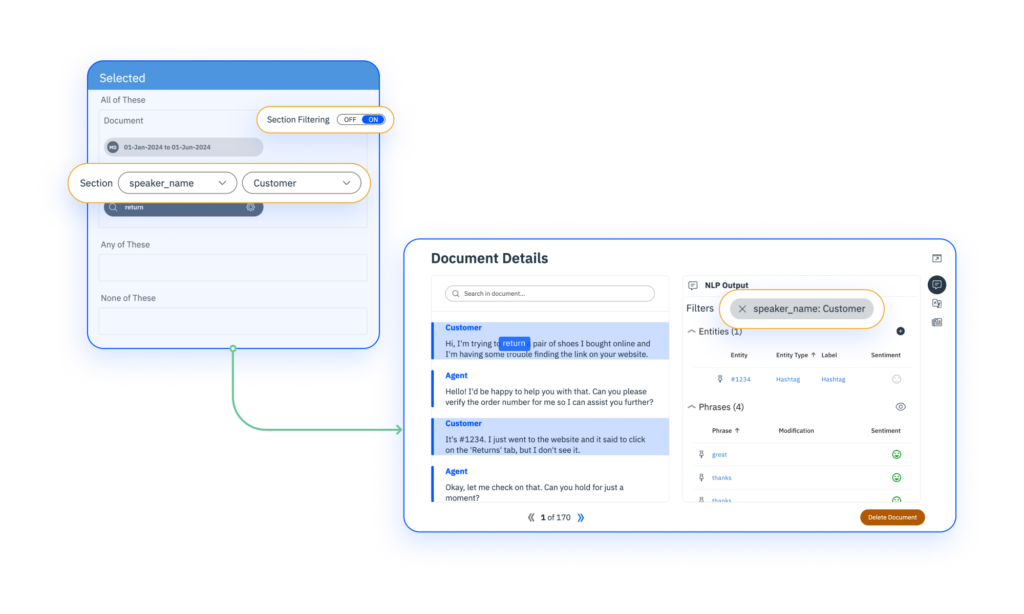

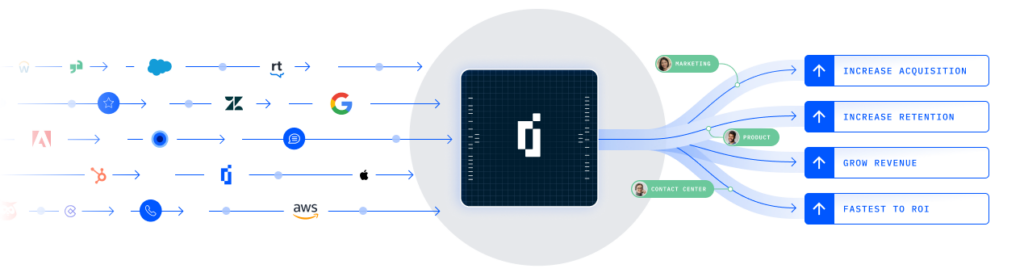

Pearl-Plaza Advanced AI is a comprehensive data analytics tool that integrates and analyzes structured and unstructured data using advanced Natural Language Processing (NLP) and AI. It offers a deep understanding of customer and employee feedback, transforming complex data into clear and actionable insights.

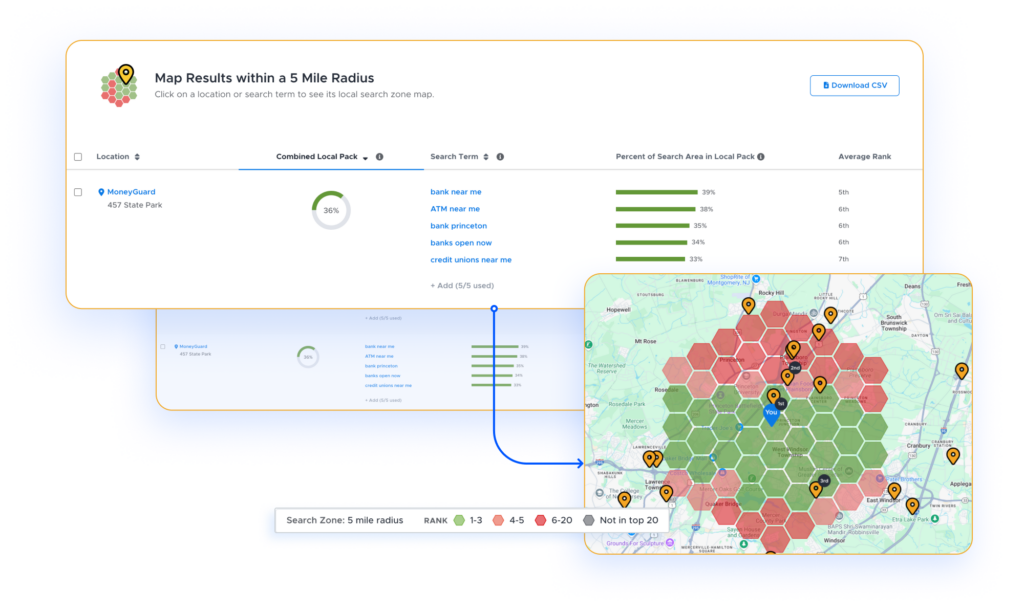

Central to Pearl-Plaza Advanced AI’s functionality are predictive analytics and customizable dashboards, which enable businesses to understand current data trends and anticipate future customer patterns and behaviors across these data sets.

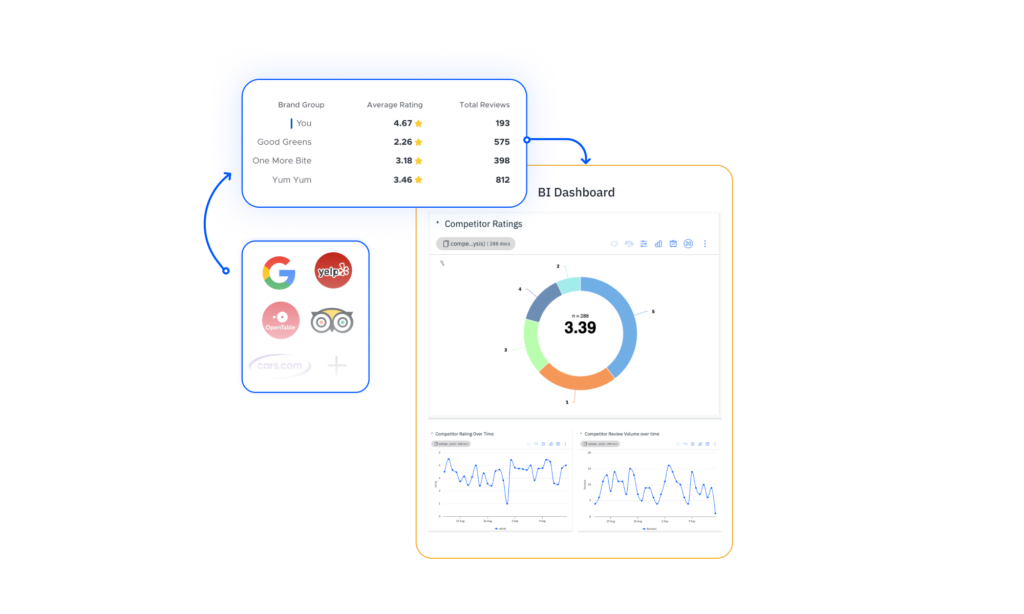

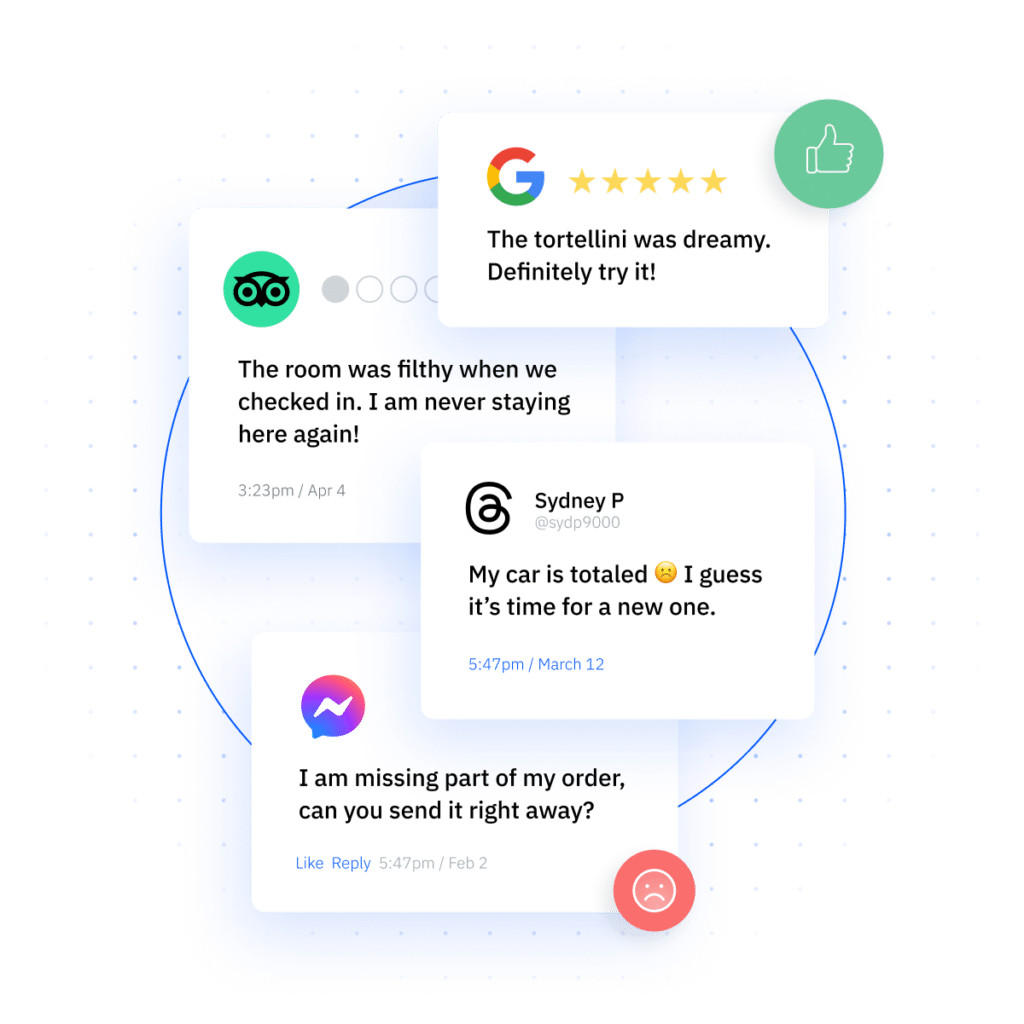

Pearl-Plaza Advanced AI’s power lies in its ability to analyze both historical customer experience data and real-time data sources like social media and reviews. This dual capability offers businesses an advantage over competitors who may excel in historical data analysis or current data interpretation, but struggle to integrate both into timely insights. Pearl-Plaza Advanced AI’s integrated approach provides a comprehensive view, turning past and present data into powerful, actionable insights for immediate strategic impact.

Pearl-Plaza Advanced AI enables businesses to process virtually any type of content, enrich and understand that content, and visualize it through a powerful set of dashboarding tools. The engine that enables this enrichment uses AI and NLP to understand the content and derive valuable metadata, including: intent prediction, effort signals, and emotion detection.

Let’s go over what these are and their broader implications.

Intent Prediction

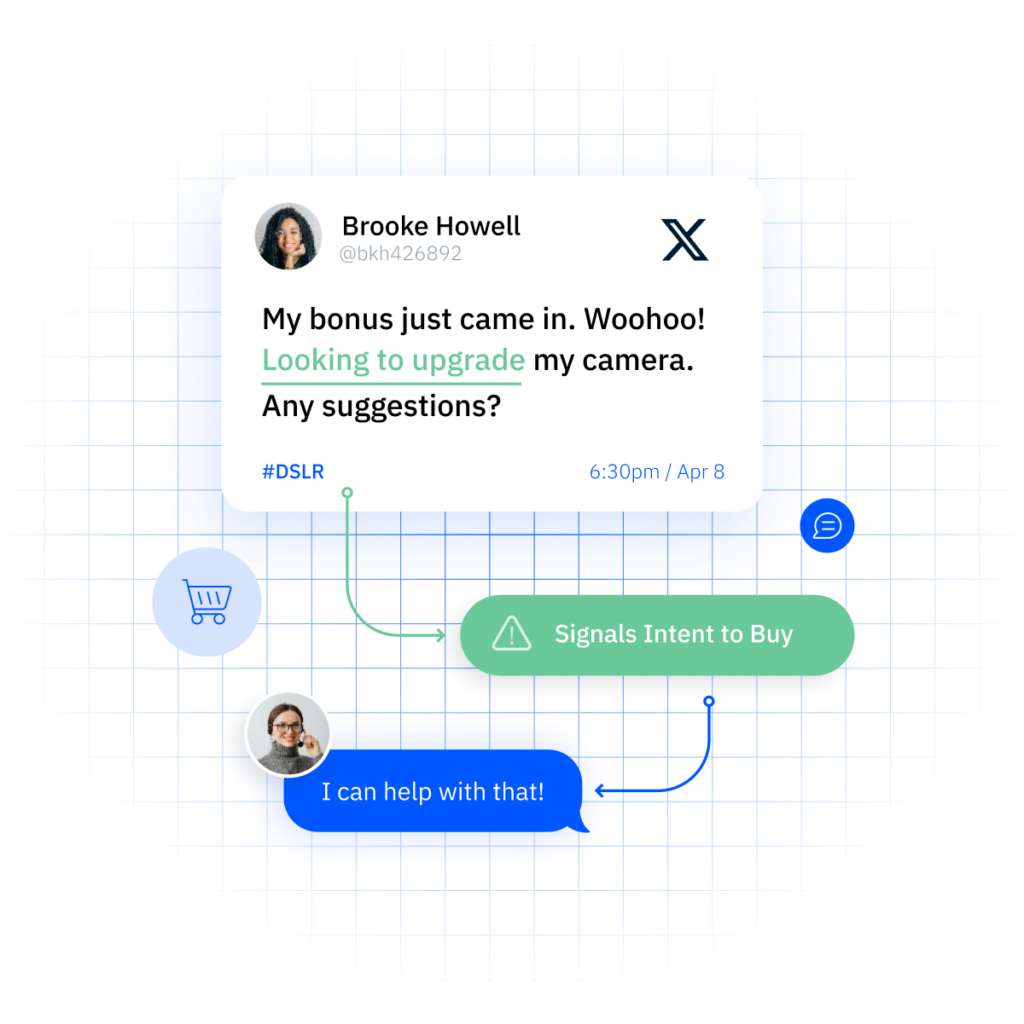

Intent prediction is a crucial component of data analysis, focusing on deciphering the underlying intentions behind customer interactions. This technology uses deep learning models to predict a customer’s future actions or needs.

For example, in customer service interactions, intent prediction can determine whether a customer is likely to purchase, seek support, or churn. By understanding these intentions, businesses can proactively address customer needs, enhancing the overall customer experience and increasing sales and customer satisfaction.

Effort Signals

Effort signals involve analyzing customer interactions to gauge the degree of effort a customer exerts in their journey. This metric is key in understanding customer satisfaction and loyalty, as higher effort levels correlate with negative customer experiences.

By analyzing data such as the length and complexity of customer service interactions, businesses can identify areas where customers face difficulties. Addressing these high-effort points can significantly improve the customer experience, increasing satisfaction and loyalty.

Emotion Detection

Emotion detection is identifying and analyzing emotional states in customer interactions. This aspect of sentiment analysis uses a BERT deep learning model to assign an emotion to the speaker or subject of a sentence or thought.

This technology can distinguish between emotions like happiness, frustration, or disappointment. Emotion detection helps businesses tailor their responses and strategies to align with customer emotions, enhancing personalized customer experiences and building stronger emotional connections with the brand.

Types of Data

Structured: The Backbone of Predictability

Structured data is the cornerstone of conventional data analysis, representing the world of quantifiable and measurable information. Characterized by its specific, organized format, structured data neatly aligns in rows and columns, reminiscent of spreadsheets or relational databases. This meticulous arrangement makes it well-suited for quantitative analysis, offering clear, objective, and mathematical insights into various aspects of business and customer behavior.

It is the language of logic and mathematics, offering a clear, structured view of the world that is easily interpreted by computers. Its strength lies in its straightforward aggregation and manipulation, allowing businesses to accurately quantify and measure trends, performance metrics, and other key indicators.

This data type is the foundation of data-driven decision-making, enabling enterprises to translate complex phenomena into understandable metrics. While it might lack the nuanced storytelling of unstructured data (we’ll get there in a second), structured data offers the definitive “what” in the story of customer and business interactions—the concrete, quantifiable facts that are essential for informed strategy and planning.

Unstructured: The Streaming Thoughts of Your Everyday Life

Unstructured data, the most raw and unrefined form, is abundant and profoundly human by nature. Emerging from sources rich in personal expression like open-ended survey questions, reviews, social media, and SMS messages, this data type offers a window into the authentic human experience.

According to IDC, The Digital Source, 85% of customer data is unstructured and it’s growing at 55% per year, highlighting the vast and rapidly expanding landscape of human communication that structured data cannot capture. Tools like Pearl-Plaza’s Advanced AI are essential in harnessing this wealth of information, translating natural language complexities into actionable insights, and unlocking the deepest understanding of customer experiences and needs.

What sets unstructured data apart is its embodiment of language. It directly reflects our unfiltered and unstructured thoughts in their most natural state. While structured data can be seen as the mathematics of human behavior, unstructured data is pure, unadulterated human communication.

This richness, however, presents a challenge: unstructured data is the hardest for computers to decipher, as it requires understanding nuances, context, and the subtleties of human language. Despite this complexity, our deepest and most meaningful insights lie in these unstructured narratives. Tools like Pearl-Plaza’s Advanced AI are essential in harnessing this wealth of information, translating natural language complexities into actionable insights, and unlocking the deepest understanding of customer experiences and needs.

Bringing Them Together: The Full Story

Integrating structured and unstructured data is a key aspect of Pearl-Plaza Advanced AI and, arguably, its strongest feature. Structured data provides precise, quantifiable insights, such as the exact factors contributing to customer churn.

While structured data gives you the numbers, unstructured data provides the “why” behind these figures. It’s found in customer verbatims and feedback, revealing the customers’ personal stories, opinions, and suggestions. It’s the narrative that puts context and meaning behind the numbers. But on its own, unstructured data can be overwhelming and hard to navigate to find the most impactful insights.

Combining structured and unstructured data tells the full story. This integration allows businesses to quantify aspects of the customer experience and understand the underlying reasons behind these metrics. With Pearl-Plaza Advanced AI, companies can sift through the rich, detailed narratives in unstructured data, guided by clear, actionable insights from structured data. This holistic approach enables a deeper understanding of customer needs and preferences, leading to more informed and effective business decisions.

Pearl-Plaza Advanced AI bridges the gap.

Spotlight Addresses Key Business Challenges

Understanding and Predicting Customer Behavior

We mentioned this earlier, but we’d like to go more in-depth—this one’s important. One of the paramount challenges businesses face today is their inability to predict future customer behaviors. Pearl-Plaza Advanced AI excels in this area using AI-powered, advanced analytics and machine learning algorithms.

According to Gartner, by 2025, customer service organizations that embed AI in their multichannel customer engagement platform will elevate operational efficiency by 25%, underscoring the efficiency gains possible with advanced AI solutions. This capability enables businesses to move beyond surface-level insights, delving into predictive analysis that anticipates future customer actions and preferences.

By understanding these predictive patterns, companies can tailor their strategies proactively, ensuring they are always one step ahead in meeting customer needs and expectations. This forward-looking approach is vital for maintaining competitive advantage and fostering customer loyalty.

Data Unification and Analyzation: A Single Source of Truth

Data silos are a significant barrier to effective decision-making in many organizations.

Tyler Saxey, Director of CX at Foot Locker, states, “Pearl-Plaza now ticks all of the boxes. Pearl-Plaza AI solves for any previous text analytics issues. Analyzing call transcripts and getting to the root cause brings a big ROI.” Pearl-Plaza Advanced AI addresses this issue head-on by offering data unification capabilities, consolidating data from various sources and providing a comprehensive and unified view of customer information. This holistic approach is vital for creating consistent and effective customer experiences across all touchpoints.

By breaking down these silos, Pearl-Plaza Advanced AI ensures that all decisions involve a complete and accurate picture of customer data—no decisions are made in isolation. This unified view is invaluable for creating consistent and effective customer experiences across all touchpoints.

Regulatory Compliance: Ensuring Communication Standards

We live in a time with increased scrutiny of companies’ regulatory compliance. Pearl-Plaza Advanced AI is essential in ensuring that customer communications meet the necessary standards. This aspect is crucial for highly-regulated businesses in industries like finance, healthcare, and telecommunications.

Pearl-Plaza Advanced AI can help monitor and analyze customer communications, ensuring they adhere to industry regulations and standards. This compliance monitoring not only helps avoid potential legal issues but instills trust among customers, who are increasingly concerned about how their data is handled and used. With nearly 65% of the world’s population expected to have its personal data covered under modern privacy regulations by 2023, up from 10% today, according to Gartner, the importance of incorporating advanced AI for regulatory compliance cannot be overstated.

Why Spotlight is Essential for All Businesses

Enhancing Experiences: Tailoring Strategies for Satisfaction and Loyalty

Pearl-Plaza Advanced AI significantly enhances customer and employee experiences.

Tony Darden, COO of Jack in the Box, shares, “The use of the Pearl-Plaza AI solution will allow us to easily analyze feedback in all its forms to receive more detailed and immediate insight from a wider variety of guest experiences. Our team is focused on using the additional insight to make business decisions without delay—having a faster time to guest improvement that will positively influence their experience with our brand leading to increased loyalty.”

By leveraging advanced analytics to understand sentiment and feedback, businesses can tailor their strategies and offerings to better meet their customers’ and employees’ needs and expectations.

Reducing Churn: Anticipating and Addressing Customer Needs

Customer and employee churn is a major challenge for businesses, resulting in lost revenue and increased recruitment and training costs. Pearl-Plaza Advanced AI’s predictive analytics capabilities play a vital role in identifying the early signs of dissatisfaction or disengagement. By anticipating these factors, businesses can proactively address issues before they lead to churn. This proactive approach helps retain customers and ensures that employees feel valued and engaged, reducing the likelihood of them seeking opportunities elsewhere.

Strategic Decision-Making: Prioritizing Initiatives for Maximum Impact

Data-driven decision-making is at the heart of modern business strategies. Pearl-Plaza Advanced AI provides comprehensive insights that help businesses prioritize their initiatives, focusing on areas yielding the greatest cost savings or revenue increases. These insights guide businesses in allocating resources effectively, whether it’s refining marketing strategies, optimizing operational processes, or enhancing customer service. By basing decisions on solid data, businesses can maximize their ROI and align their strategies with their overall goals.

The Takeaway: A Holistic Approach for a Winning Strategy

Pearl-Plaza Advanced AI’s ability to integrate data across multiple channels is a game-changer, providing a unified view of information from various sources. This cross-platform integration is crucial for strategic planning and executive decision-making. It allows businesses to make informed decisions based on a comprehensive understanding of their operations, market trends, and customer behaviors.

By breaking down data silos, Pearl-Plaza Advanced AI ensures that a complete and accurate picture of the business landscape backs every decision. A study by McKinsey & Company found that companies that utilize customer analytics comprehensively are 23 times more likely to outperform competitors in terms of new-customer acquisition and nine times more likely to surpass them in customer loyalty.

Pearl-Plaza Advanced AI’s ability to transform this unified data into actionable strategies makes it indispensable. Its benefits are wide-ranging and impactful, from enhancing experiences and reducing churn to aiding in strategic decision-making and facilitating cross-platform data integration. Adopting Pearl-Plaza Advanced AI is not just a step towards better data analysis, but a leap towards a more informed, customer-centric, and efficient business model.

For businesses considering Spotlight:

- How are you currently gathering and interpreting customer and employee feedback?

- What tools are in use for understanding customer and employee experience?

- How is this data being used to drive experience initiatives?

A Final Word

Pearl-Plaza’s Pearl-Plaza Advanced AI stands out in the realm of customer experience management. Its ability to harness structured and unstructured data, combined with advanced analytics, positions it as an indispensable tool for businesses aiming to enhance customer engagement and make data-driven decisions.

Adopting Pearl-Plaza Advanced AI translates into not just collecting feedback but transforming it into a strategic roadmap for business success. Stay ahead of the pack and contact us to learn more about how Pearl-Plaza Advanced AI can directly impact your business.