Tech Outages and Customer Feedback: How a Leading Bank Leveraged Pearl-Plaza’s Platform

The CrowdStrike outage shows the need to be prepared when crises happen, as they don't just impact operations—they shake customer confidence and loyalty.

Did you know that 77% of customers expect to interact with someone immediately when they contact a company during a crisis?

In our hyper-connected world, tech outages and cybersecurity incidents have become an unfortunate reality. The recent global outage affecting major service providers like Microsoft and CrowdStrike has highlighted the need for businesses to be prepared. When such disruptions occur, they don’t just impact operations; they shake customer confidence and loyalty. For enterprise companies, the stakes are even higher. The key to navigating these turbulent times lies in capturing and responding to customer feedback as quickly as you can.

Recognising the urgency, Pearl-Plaza experts have quickly put together a framework on best practices to help businesses navigate these disruptions effectively.

The Significance of Real-Time Feedback During Outages

When a tech outage hits, customers immediately feel the impact. Whether it’s a supermarket where transactions are delayed, a bank with disrupted online services, or an airport where flight information systems go down, the frustration is real—and customers have little bandwidth for the inconvenience.

Real-time feedback during these moments is more important than ever before. It allows businesses to understand customer pain points as they happen and to respond as quickly as possible.

Capturing feedback in real time isn’t just about damage control—it’s about gaining insights into the customer experience during a crisis. This immediate understanding helps businesses prioritize issues, allocate resources effectively, and maintain a proactive stance rather than a reactive one.

What Sources Should You Be Capturing?

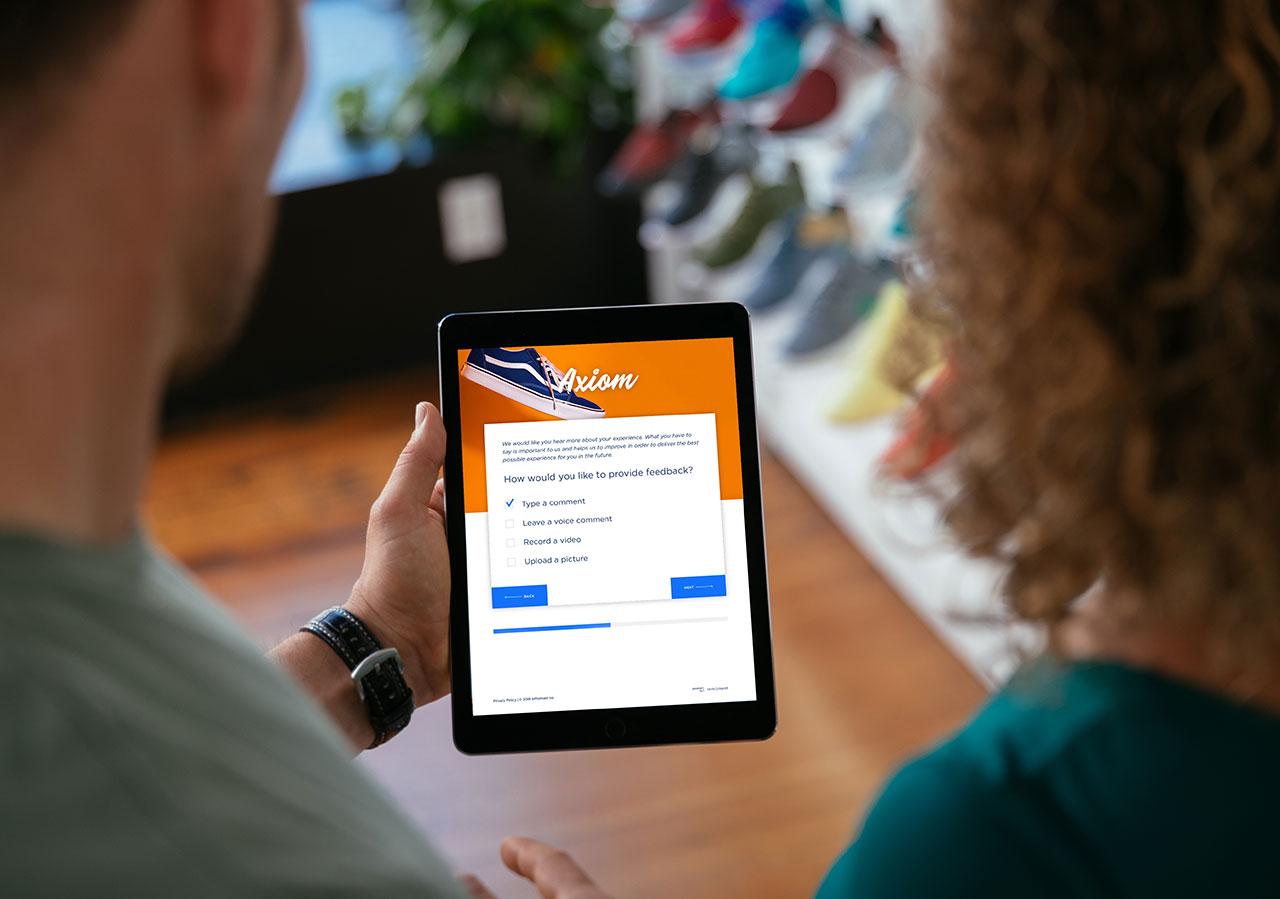

During a crisis, feedback floods in from various channels—social media, emails, call centers, in-app messages, and more. Manually sorting through this avalanche of information is just not possible.

Your CX platform should be aggregating feedback from all these sources, providing a holistic view of customers—what they’re feeling, what they’re saying, what they need. Whether a customer is calling about a delayed service, emailing about an inaccessible account, or leaving a message through your app, your CX platform should be capturing all of it. This omnichannel customer experience approach makes sure that no feedback is overlooked, and enables your businesses to respond effectively to the most pressing issues.

How a Leading Bank Used Pearl-Plaza’s Platform to Navigate a Major Tech Outage

When the recent tech outage disrupted services across multiple industries, a leading Australian bank found itself at the epicenter of the crisis. With online banking services down and customers unable to access their accounts, the potential for a significant loss of trust and satisfaction was high. But, by leveraging Pearl-Plaza’s Advanced AI and Workflow capabilities, the bank was able to turn a potential disaster into a proof point that highlights its commitment to customer experience.

Identifying and Analyzing Feedback with Advanced AI

As soon as the outage hit, the bank saw a surge in customer inquiries and complaints across various channels, including emails, call centers, social media, and their mobile app. Sorting through this massive influx of feedback manually would have been in impossible. Instead, the bank utilized Pearl-Plaza’s advanced natural language processing (NLP) to aggregate and analyze the feedback in real time.

The AI-powered text analysis software swiftly categorized the feedback based on urgency and topic, identifying the most affected services, such as online transactions, account access, and customer support. By using NLP, the system was able to understand the underlying sentiment and priority level of each piece of feedback. This allowed the bank to quickly understand the most critical pain points for their customers.

Proactive Communication with Targeted Updates

Using these insights, the bank implemented a proactive communication strategy. They used Pearl-Plaza’s workflow capabilities to automate and personalize their responses, ensuring that each customer received timely and relevant updates. Here are some examples:

- Emails and Notifications: Customers who prefer using online banking received detailed emails explaining the nature of the outage, expected resolution times, and alternative ways to manage their accounts during the downtime.

- Social Media Responses: The bank’s social media team was equipped with data-driven insights to address widespread concerns and provide real-time updates on platforms like Twitter and Facebook.

- Call Center Scripts: Pearl-Plaza’s platform helped create dynamic call center scripts that guided agents in addressing the most common issues and providing accurate information to anxious customers.

Ensuring Transparency and Maintaining Customer Satisfaction

The bank’s commitment to transparency was evident through their consistent and honest communication. They didn’t shy away from acknowledging the inconvenience caused by the outage and re-assured customers by detailing the steps being taken to resolve the issues. This transparency helped in maintaining customer trust and satisfaction during a challenging time.

Strengthening Customer Relationships with AI-Driven Insights

Beyond managing the immediate crisis, the bank used the incident as an opportunity to strengthen their customer relationships. Pearl-Plaza’s Advanced AI tool provides deep insights into the specific needs and preferences of their customers. For example, they identified a segment of customers who preferred SMS updates over email, and they can adjust their communication strategy accordingly.

By analyzing the feedback and outcomes, the bank can now implement several improvements for a stronger future:

- Enhance their digital infrastructure to prevent similar outages in the future.

- Develop more robust contingency plans and customer communication protocols.

- Personalize customer service strategies based on the preferences identified during the crisis.

By aggregating and analyzing feedback in real time, automating personalized responses, and maintaining transparent communication, the bank was able to manage the crisis effectively and even strengthen their customer relationships.

For CX Leaders, this case study underscores the importance of leveraging advanced technology to handle crises. Pearl-Plaza’s integrated customer experience platform provides the tools necessary to not only respond to immediate challenges but also to build a more resilient and customer-centric organization.

Improve Your Crisis Management with Pearl-Plaza

Ready to transform your crisis management strategy? Learn how Pearl-Plaza can help you capture real-time feedback and enhance customer loyalty during tech outages. Talk with an expert today for more information.

References

Salesforce. State of the Connected Customer Report. (https://www.salesforce.com/resources/research-reports/state-of-the-connected-customer/). Accessed 7/19/2024.