Driving the Future: Integrated CX in Automotive Customer Journeys

The automotive industry is in the midst of a huge transformation. It’s driven, in part, by product innovation. Advancements in electric vehicles are leading to increased adoption, and concepts that were once pipe dreams—such as connectedness and autonomous vehicles—are becoming a reality.

At the same time, we’re seeing a massive shift in the way consumers want to browse and buy vehicles. Automotive brands need to understand customers’ needs and preferences, and then adapt accordingly, to deliver outstanding experiences that win and retain customers. Data is foundational to achieving these goals.

Let’s take a closer look at how integrated CX platforms, and AI-powered tools in general, enable automotive brands to deliver intelligent, bespoke experiences that successfully attract, convert, and retain customers.

Hyper Personalized Experiences for Every Car Shopper

Each car shopper has unique needs and preferences. They expect brands to understand them in turn, and then use those insights to deliver ultra personalized experiences, communications, and offers. Delivering these ultra-personalized experiences to every customer, every time, can seem like an impossible task; AI not only makes it possible, but achievable at scale.

Integrated CX platforms, powered by AI, pull customer signals from various sources, such as purchase history, past engagements, surveys, ratings and reviews, and social media interactions. Collectively, these signals provide a 360-degree view into each customer. Auto brands can tap into these insights to deliver personalized experiences throughout the entirety of the purchase journey.

With integrated CX, automotive brands have insights to understand:

- What happened: Descriptive insights describe what has happened. For example, let’s say a customer purchased a specific vehicle five years ago—and has returned to the dealership for 10 service appointments. Perhaps they wrote a positive review about their dealership experience. Recently, they’ve started spending more time on the business’ website and engaging on social media.

- Why and how it happened: Diagnostic insights enable automotive brands to understand the reasons behind a customer’s behavior. Then, they’re better equipped to deliver experiences that align with that reasoning.

- What will happen in the future: Predictive customer analytics leverage data to make predictions about a customer’s future behavior. For example, an organization can analyze purchase history and other interaction data to make a prediction about when a customer will be in the market for a new vehicle. When automotive brands can anticipate customers’ future needs, they’re better positioned to proactively address those needs.

Automotive brands that leverage integrated CX to deliver personalized experiences will be better positioned to capture shoppers’ attention—and win their business. In fact, personalization is proven to drive bottom line results. Research from Deloitte found that 69% of consumers are more likely to buy from a brand that delivers personalized experiences.

Outstanding Online Buying Experiences

It’s no secret that e-commerce continues to grow. Insider Intelligence predicts that global ecommerce will grow 9.4% this year, reaching $6.876 trillion. To put this in perspective, over 20% of retail sales are expected to happen online.

We’re also seeing an increase of consumers purchasing products online that were traditionally purchased in brick-and-mortar locations—vehicles are one example. A recent survey from PwC found that 64% of automotive dealers believe online sales will comprise 20-40% of all sales by 2030.

There are many reasons why more consumers are willing to buy vehicles online, with convenience topping the list. Yet, one of the clear advantages of shopping for a vehicle in-person is the ability to ask questions and get personalized recommendations.

AI Enables Brands to Bridge This Gap

Automotive brands can deploy chatbots to interact with automotive buyers throughout the purchase journey. These chatbots can answer customers’ questions at any hour of the day. This is essential, as 77% of consumers expect instant engagement when they contact a business. By addressing purchase blocking questions in real-time, automotive brands can boost shoppers’ confidence—and their likelihood of making a purchase.

In addition, chatbots can deliver personalized recommendations to car shoppers based on existing customer data and any additional data that’s collected during the chat. For example, a chatbot can recommend a specific model with added features that address the needs of the customer.

Conversational intelligence tools can be developed to address many different types of customer queries. However, there will always be situations where human involvement is required. Chatbots can identify these situations—and ensure customers are routed to an employee that’s equipped to handle the situation. That means customers will get their questions and issues addressed quickly, which will boost satisfaction.

Optimized In-Person Experiences

A growing portion of consumers are open to purchasing vehicles online. But that doesn’t mean that car dealerships are a thing of the past. The majority of consumers still buy cars in a physical car dealership. A survey from J.D. Power found that 85% of car buyers visited a dealership during the purchase process. Per research from Progressive, some of the top reasons for visiting a dealership location include:

- The ability to do a test drive

- The ability to compare vehicles in person

- Habit (it’s the way I’ve always done things)

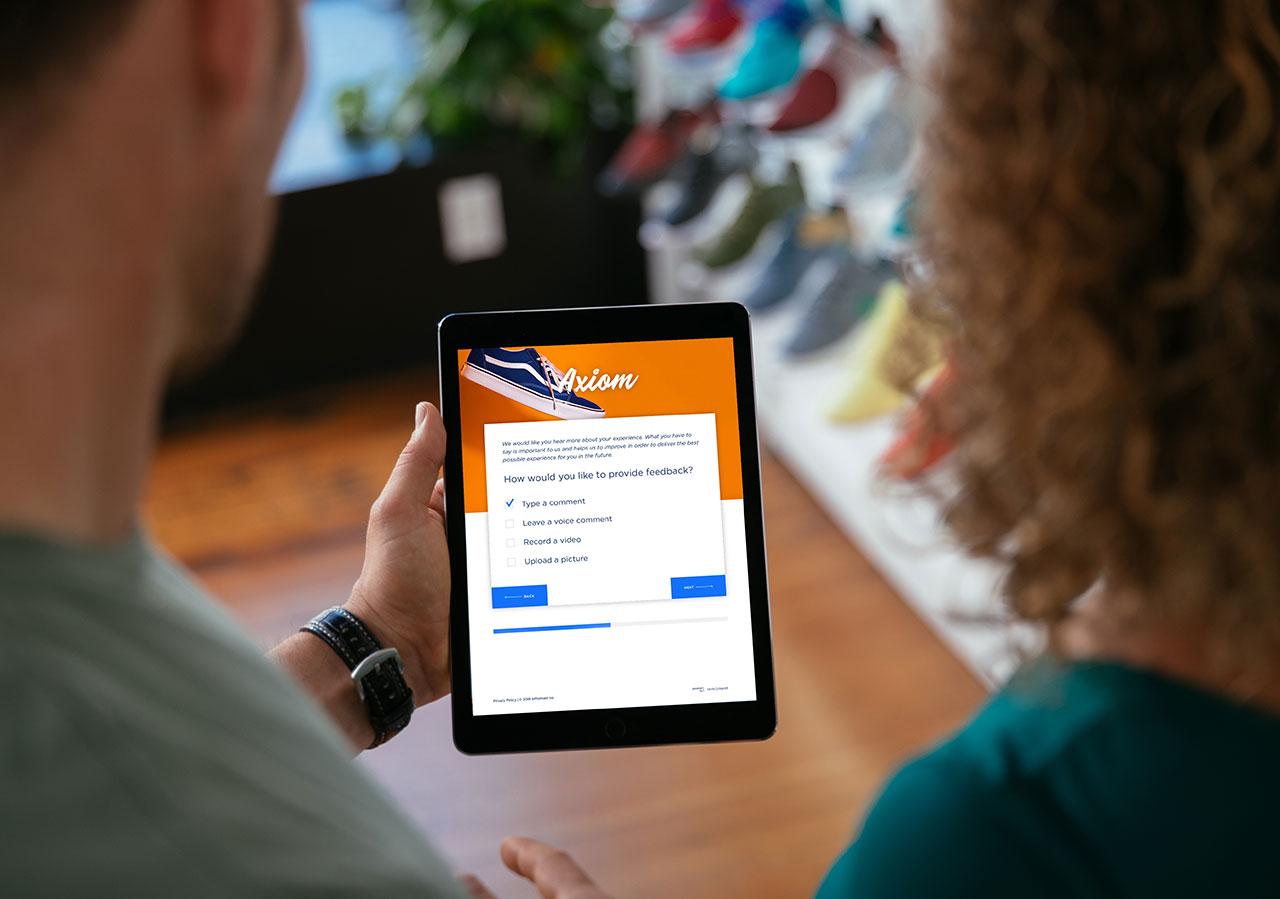

Many shoppers leave the dealership leaving less-than-satisfied. Automotive brands must work to optimize in-dealership experiences. Collecting and analyzing feedback is key to understanding customers’ pain points—and then working to alleviate them.

Collecting customer feedback certainly isn’t a new concept. Even before the growth of ecommerce, many car dealers asked their customers to share their feedback by completing surveys and comment cards. Today, many automotive customers are willing to share their feedback. But they do so in different ways.

Seamless Experiences Across Channels

As we’ve already explored, consumers are becoming increasingly comfortable with purchasing cars online. When it comes to car buying, it’s often not a question of online vs. in-dealership. Instead, many consumers do both.

Imagine a consumer in the market for a vehicle. They start the purchase journey by researching their options and asking questions online. This approach is common. An analysis from Google and comScore states that twice as many vehicle buyers start their research online, opposed to a dealership.

Automotive brands must ensure consumers have seamless, connected, and personalized experiences across all channels they use. Consumers expect this. Per Salesforce, nearly eight in 10 (79%) expect consistent interactions across departments.

With integrated CX platforms, brands can effectively and efficiently synthesize and analyze data across channels to understand a customer’s behavior and intent. Pearl-Plaza’s integrated CX platform is the highest rated in the market for this end.

Fostering Loyalty by Delivering Ongoing Value

There’s an old adage that retaining a customer is less expensive than acquiring a new one. But retaining automotive customers can be challenging, as they aren’t as loyal as we’d like to think. Consider the fact that in 2022, 37% of new vehicle buyers bought a brand they’d never owned before. This is up from 31% the prior year. Optimized experiences foster loyalty and repeat business. However, those experiences must extend beyond the sale.

Automotive brands can leverage AI to deliver outstanding post-sale experiences that foster loyalty. For example, brands can engage with customers to let them know when it’s time for routine maintenance—which can be scheduled via chatbot. Customers can also pose maintenance-related questions via chatbot and get instant answers.

In addition, automotive brands can use AI to analyze signals indicating a customer may be in the market for a new vehicle. Then, the brand can proactively engage with the customer to meet their needs.

A Final Word

We’ve only just scratched the surface of AI’s massive potential. Yet, it’s already completely transforming the way consumers engage with auto brands, and the world in general. With integrated CX providing a holistic view of the customer base, auto brands can tailor their products, services, and experiences to exactly what their customers want.

The auto brands that follow this blueprint will remain at the forefront of the industry.

References

Mckinsey & Company. The value of getting personalization right—or wrong—is multiplying (https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/the-value-of-getting-personalization-right-or-wrong-is-multiplying/). Access 1/16/24.

Salesforce. State of the Connected Customer Sixth Edition. (https://www.salesforce.com/resources/research-reports/state-of-the-connected-customer/). Access 1/16/24

Deloitte. Embrace meaningful personalization to maximize growth. (https://www.deloittedigital.com/content/dam/deloittedigital/us/documents/offerings/offering-20220713-personalization-pov.pdf). Access 1/16/24

Insider Intelligence. Ecommerce growth worldwide will pick up before tapering off. (https://www.insiderintelligence.com/content/ecommerce-growth-worldwide-will-pick-up-before-tapering-off). Access 1/16/24

Forbes. Global Automotive Market: Predictions for 2024. (https://www.forbes.com/sites/sarwantsingh/2024/01/11/global-automotive-market-predictions-for-2024/). Access 1/16/24

J.D. Power. 2022 U.S. Sales Satisfaction Index (SSI) Study. (https://www.jdpower.com/business/press-releases/2022-us-sales-satisfaction-index-ssi-study). Access 1/16/24

Progressive. Consumers embrace online car buying. (https://www.progressive.com/resources/insights/online-car-buying-trends/). Access 1/16/24

Google/comScore. U.S. Automotive Shopper Study. (https://www.thinkwithgoogle.com/consumer-insights/consumer-trends/digital-car-research-statistics/). Access 1/16/24.

Auto Dealer Today. Customers less satisfied with buying process in 2022. (https://www.autodealertodaymagazine.com/369850/customers-less-satisfied-with-buying-process-in-2022#). Access 1/16/24

Edelman. Trust Barometer Special Edition. (https://www.edelman.com/sites/g/files/aatuss191/files/2019-07/2019_edelman_trust_barometer_special_report_in_brands_we_trust.pdf). Access 1/16/24.