How To Shorten Customer Surveys Without Losing Valuable Insights

Shorter customer surveys boost engagement and response rates. Learn why less is more and get tips on optimizing your surveys effectively.

Let’s face it: shortening your customer experience survey can be overwhelming. You have so many priorities, stakeholders, and initiatives to inform and consider, but you want to capture that information with as few questions as possible in order to avoid survey fatigue.

But shortening customer surveys is worth the investment. With shorter surveys, your business will get more responses, and those responses will be more accurate and complete.

Here’s what you need to know about shortening surveys—the right way.

Benefits of Shortening Customer Surveys

There are plenty of reasons to move away from long annual surveys in favor of more frequent microsurveys. No matter what form your surveys take today, shortening them can deliver benefits like:

Increased customer engagement

Shorter surveys are less intimidating, which encourages more customers to complete them and improves their overall experience while doing so.

Long, complex surveys can create survey fatigue, leading to two different negative outcomes:

- Some survey respondents will give up on the survey partway through

- Some may form a negative customer sentiment based on a time-consuming (or seemingly invasive) survey

Our research shows that shorter is better: Surveys with seven questions or less have the best likelihood of being completed.

Improved Data Quality and Accuracy

One reason brands go for longer surveys is data quantity. With a longer survey, you’ll get more data from every respondent—sounds like a good thing, right?

Not so fast: More data is good, but only if it’s good data.

One rigorous academic study on big data determined that increasing data quantity without maintaining or increasing quality accomplished nothing positive at all.

Longer surveys may cause survey respondents to rush through their answers, or even provide inaccurate responses in an effort to get the process over with. It also increases your risk of survey abandonment.

In contrast, narrowing your survey to a smaller set of well-crafted questions can improve response rate and accuracy, delivering more meaningful insights and higher-quality survey data.

Enhanced Customer Experience and Brand Perception

Survey fatigue doesn’t just affect data quality—it can even damage your brand by harming the customer experience.

Most of us have been snagged by a poller conducting a telephone survey for some cause or group. The representative claims they need “just five minutes of your time.” Yet somehow, 30 minutes later, you’re still answering obscure, granular questions (and probably starting to sour on the group behind the poll!).

Even more so in retail, customers appreciate brands that respect their time and are transparent about what they’re asking in online surveys.

A well-designed, concise survey can actively improve brand perception and customer satisfaction. Customers feel heard and sense that your brand cares about what they have to say—while also respecting their time.

Reduced Survey Abandonment

Brands are constantly looking for ways to increase survey response rates, but getting a user to click on a survey link isn’t the whole goal. You also need that user to stick with the survey all the way to the end.

Surveys that are abandoned midway typically aren’t usable, so lowering the abandonment rate is a great way to improve data quality and true response rate.

When you minimize the survey length and complexity of your brand’s surveys, you increase survey completion rates and lessen the likelihood of customers abandoning them partway through. This is a powerful change: You get more reliable and actionable feedback, and fewer customers get frustrated with the survey experience.

How Long Should Customer Surveys Be?

The general rule is that your survey should ask as few questions as possible while still getting your business all the answers you need. Ideally, a customer survey should take five minutes or less to complete.

Remember: Customers want to give direct feedback—but they also don’t want to spend more than a few minutes doing so.

To be transparent, brevity isn’t a cure-all. While a compact questionnaire can help produce more valuable responses, it doesn’t guarantee a higher response rate than a long survey.

The vast majority of non-response actually occurs on the first page of the survey or when respondents never open the survey after receiving an invite—meaning that many non-responders do so before they see how short or long the survey is.

Still, as we’ve shown, shortening surveys provides real value beyond response rates, like better engagement and brand perception, higher quality data, and a lower abandonment rate.

Dive deeper into this topic in our white paper by Dave Ensing: How short should you make your survey?

1. Aim for Short, but Complete Surveys

When creating a survey, ask as few questions as you can while still getting all the answers you need. Yes, that’s easier said than done, but not impossible!

We recommend using a backward research process where you first ask your internal team, “What decisions do we want to make when we get our survey results, and what information do we want to be able to tell others?”

Having other corporate departments in mind will help you create a short survey that’s still comprehensive.

Additionally, your survey should include an open-ended question that allows your customers to talk about whatever they want. Your brand will get a better idea of what customers care about and want changed—and what you need to do to take action.

Keep in mind that “short for shortness’ sake” is not necessarily a good thing. Customers are sometimes willing to take longer surveys, but it’s the thoughtfulness and quality of each question on a survey that matters.

Your survey should be long enough to allow your customers to completely express themselves and tell their stories. With that context, your CX platform will be able to identify opportunities to maximize success and minimize friction—and isn’t that what we all want out of our customer surveys?

2. Think of Others Before Cutting a Question

A brand typically shortens its surveys because it isn’t using all the information. This makes sense, but the reality is that data can often become siloed, keeping other departments in the company in the dark.

Corporate research managers may forget how their information can be useful for other departments (e.g., marketing, product development). So before cutting a question, make sure you know how that question relates to all segments of your business—not just your department.

Additionally, before cutting a question, make sure you know who “owned” that question, and let them know why it’s being cut. For instance, if the information that stakeholder needs is already available elsewhere (such as via customer relationship management (CRM) software like Salesforce), let them know.

Similarly, when shortening your customer experience survey, always keep the customer in mind. When we asked customers why they respond to CX surveys, the top reason was because they believed that companies valued their input.

Asking meaningful questions shows the customer that your business truly cares.

And you can go even further! For example, an Pearl-Plaza client that manufactures medical devices and supplies tells customers they care by sending them letter updates explaining how they’ve taken action based on their survey responses.

3. Use Clear Language

You’ve heard it said that getting the right answers requires asking the right questions, but that’s not quite the whole story. You also have to make sure that your audience understands those questions (as well as their options for answering them).

A vague question or one with an unclear answer scale will lead to muddled answers that harm your data quality and decision-making. In other words: Ask a bad question, get a bad answer.

In your surveys, use simple, direct wording that’s tough to misinterpret. Also, make sure questions have a single subject/topic. Asking, “Did the sales and customer support teams meet your expectations?” creates confusion, since a “no” answer doesn’t tell you whether sales, CS, or both were the culprit.

Instead of asking an open-ended question and letting the respondent answer with a “yes” or “no,” use a survey tool with a feature like Pearl-Plaza’s AI-powered Active Listening. Active Listening uses AI to prompt for more details specific to what’s been shared, allowing a single question to get more actionable information.

4. Optimize Survey Flow and Structure

Questions are easier to understand when they arrive in a sensible order, so take time to evaluate and optimize the progression of your survey. Does question 2 build on the context of question 1, or does it veer off into a totally different area, giving respondents mental whiplash?

If your survey is a little more complex, this could be a great place to use some split testing or A/B testing to determine optimal flow and structure.

5. Keep Response Options Concise and Relevant

You want to gather as much information as possible—to an extent. But you don’t want to give respondents unnecessary opportunities to muddy your data. For most questions, limit answer choices to only those that are necessary and relevant. Surveys that do this are easier to complete, and they deliver higher-quality data.

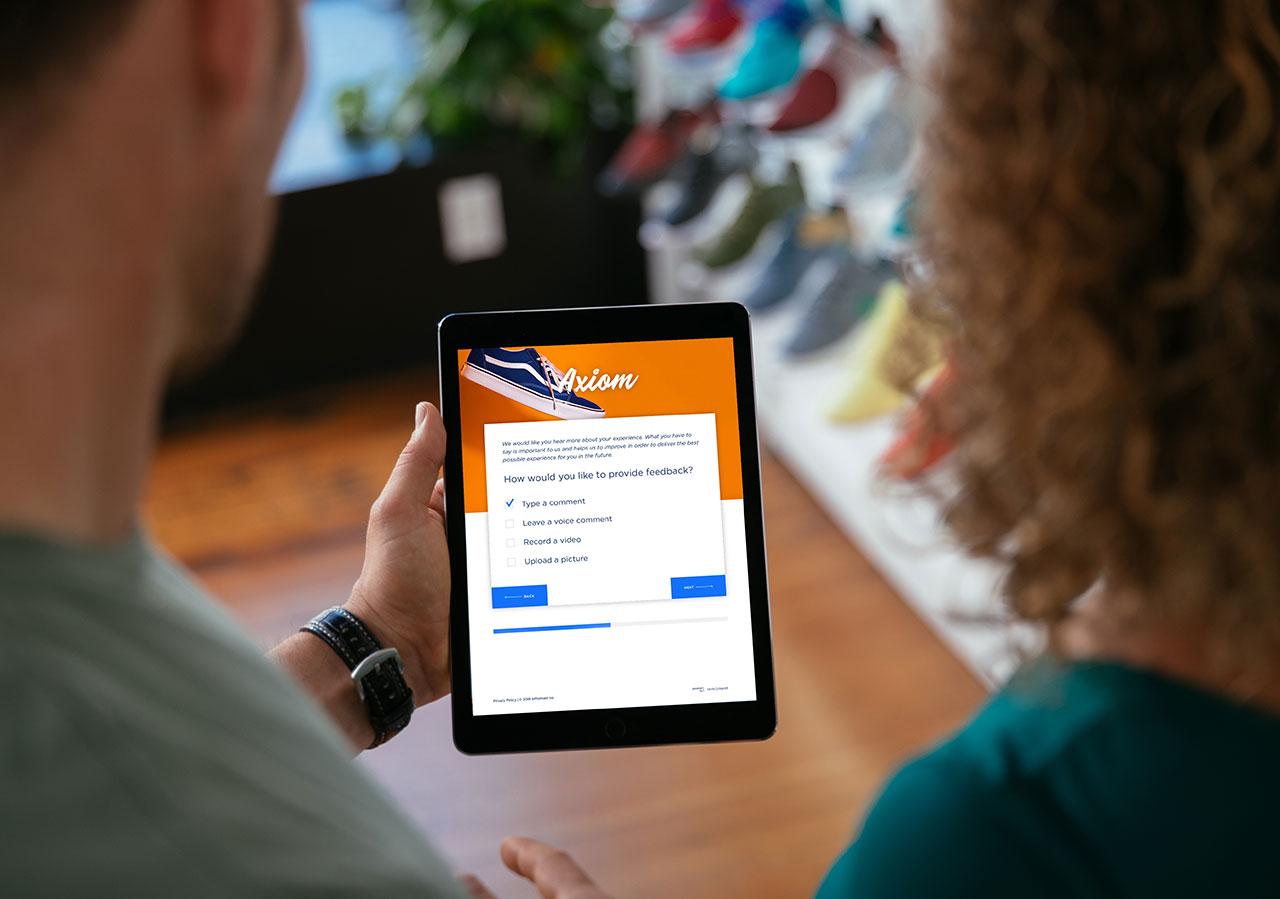

6. Make Your Survey Visually Appealing

Most of the time, you can’t control how and where people respond to your surveys, so make sure your survey works and looks good on any device type (phone, tablet, computer).

Also, in an age of phishing schemes everywhere we turn, you don’t want customers worrying whether your survey is legit. So, make sure your survey is visually consistent with your brand’s imagery and design.

Build More Effective Customer Surveys With Pearl-Plaza

Building better (and often shorter) customer surveys can empower your business to learn more from survey responses and adapt more quickly to what you learn. And it all starts with the right CX platform.

Pearl-Plaza is the Integrated CX platform built for enterprise businesses that need to understand customers and customer feedback at scale. It’s perfect for building customer experience surveys, and its advanced Conversational Intelligence capabilities can draw out insights even from unstructured data (like freeform and short answer survey question types).

See how easy it is to create powerful microsurveys with Pearl-Plaza: Get started with Pearl-Plaza